Building strong brands isn’t getting any easier. An explosion in the number of brands—as well as a proliferation of ways to communicate them, from hundreds of cable channels to the Internet, product placement in movies, and even mobile-phone display screens—has made it tougher to get messages through. In addition, converging product-performance and service levels in many industries have made it more difficult to sustain existing brands.1 Meanwhile, the economic downturn has hamstrung marketers by cutting their budgets (Exhibit 1).

Rising above the clutter without breaking the bank will require companies to get smarter about branding. During the 1990s, marketers spent unprecedented sums, but many discovered later that more wasn’t better. The promotional efforts of some companies were indiscriminate, focusing on aspects of the brand that didn’t drive customer buying patterns. Others failed to note shifting customer preferences and evolving market segments; Volvo, for example, lost out on years of potential sales by waiting until 2003 to introduce a sport utility vehicle. In short, marketers relied too heavily on intuition and not enough on a fact-based understanding of the marketplace.

A few companies are starting to build their brands more scientifically—and in doing so have pushed marketing to new frontiers. The key is combining a forward-looking market segmentation with a more precise understanding of the needs of customers and a brand’s identity. The wealth of information about customers and buying patterns (obtained by studying everything from loyalty programs to cheap Internet-based surveys) and the availability of more sophisticated and accessible statistical tools make it possible to undertake these tasks with more precision and accuracy than ever. In short, reaching the next level requires a more rigorous, data-based edge to branding.

Certainly, even the most advanced quantitative techniques can’t save brands whose value propositions lag behind those of competitors. And adopting new methodologies has its challenges. The solid analytics at the heart of the new approach may not only require new skills in the marketing department but also highlight steps that other parts of the organization—from product development to operations to customer service—must take to help deliver the brand. Moreover, some marketers may worry that adopting more quantitative techniques will compromise their creativity. In our experience, though, getting analytical about customer needs and the brand identity helps channel the imagination into areas in which it makes a difference. And the ability to avoid costly trial and error and to build a better brand more efficiently is too compelling to pass up, particularly in challenging economic times.

Tomorrow’s segments today

The first order of business is to take a hard look at the long-term profit potential of each customer segment; otherwise, marketers can waste a huge amount of effort defining and delivering brands for segments that don’t warrant the investment. While no good brand manager ignores shifts that are clearly under way, marketers have traditionally based their segmentation schemes on current conditions, such as the size, income, age, and ethnicity of various target populations; estimates of their consumption and loyalty; and information about their locations, lifestyles, needs, and attitudes.

Helpful as traditional segmentation efforts are, they run the risk of leading companies to chase customer groups with weak long-term potential. Many apparel companies, for example, target the fad-conscious teenage segment. But now, with teenagers representing a declining demographic in many Western economies, the fruits of figuring out how to cater to these fickle customers seem likely to shrink. Fortunately, deciding when it’s time to rethink a segment doesn’t require marketers to gaze into a crystal ball; rather, they must only spot developing trends, work out how the changes will affect a segment, and assess the impact on future profitability.

Trend spotting

Winning the race in any given segment is much easier with the wind of a strong trend at your back. Major transformations—from behavioral changes, such as dietary shifts, to demographic evolution, such as the aging of the baby boomers and the swelling of the US Hispanic population—can be a marketer’s friends, but only if they are identified and embraced.

Consider the impact that an increase in the frequency of on-the-move eating and the growing popularity of the high-protein, low-carbohydrate Atkins diet could have on breakfast cereal producers such as Kellogg’s and Quaker Oats. Cereal customers have long been divided into an adult segment (for which brands emphasize health issues, including fiber content and ingredients that lower cholesterol) and a kid segment (appealed to by stressing fun and taste while reassuring mom and dad about the nutritional content). Cereal-focused market research would be unlikely to suggest modifying this approach. Yet on-the-move eating has already helped products such as NutriGrain bars, which appeal to both segments, succeed at the expense of some breakfast cereals. And more than 15 million people in the United States have tried the Atkins diet, so assessing the future economic potential of a "protein-seeking" segment that eschews the carbohydrates in breakfast cereals is important.

The segment’s size today would be only a starting point. Marketers would also need to project their estimates on the basis of obesity rates, the number of Atkins books sold, growth rates in the markets that embraced Atkins first, and the adoption trajectories of past diet crazes. While such estimates are bound to be uncertain, projections with an error range as large as 20 percent can still help marketers bound the potential impact of trends, decide which are worth reacting to, and identify those (for instance, the grapefruit diet) that are flashes in the pan.

Follow the money

Once marketers have spotted meaningful trends, the next challenge is to determine their probable impact on the customer landscape and the likely profitability of the resulting segments. Rapidly growing ones may not be the most profitable down the road, so it’s vital to translate growth projections into dollars and cents.

Consider what has been happening in the hospitality sector. For decades, the industry recognized two customer segments: service-oriented business travelers and price-driven leisure travelers. In recent years, however, the highly profitable business segment has begun splintering, with threatening implications for hotels (including stalwarts such as Hilton Hotels, Marriott International, and Sheraton) whose brands are associated with traditional business travelers and their needs. At one end of the spectrum, rising pressure on corporate expenses has produced a new kind of value-driven business traveler. At the other, a new breed of mobile, aspiring professional will go to great lengths to avoid standard business hotels, for these luxury-driven business travelers increasingly wish to merge work and play. Some are "fashion-seekers," who view the hotels they patronize as a form of personal expression. Others are "escape-seekers," who are looking for a break from the humdrum of business on the road and want to feel pampered.

Responding effectively to these pressures requires an understanding of each segment’s future economic potential. Volume is part of the story, but variables such as capital requirements, changing room rates, and earnings from sideline services are important as well. Playing in the fast-growing value-business segment requires a delicate balancing act: keeping costs low enough to meet the customers’ low-price expectations profitably while spending enough to build a differentiated brand. The luxury fashion segment also presents perils: it depends heavily on spending for style and status—extras that customers might choose to do without during economic downturns. Fashionable hotels may also have to spend more to keep their bars, restaurants, and lobbies in vogue.

Such insights help marketers decide which segments to target and how to go after them. Where growth is likely but profitability less certain, the prudent course is often to limit the downside risk, perhaps by stretching existing brands to meet new needs. Some hotel chains took this approach by offering what they call "value rates" within existing properties or by creating value sub-brands such as Holiday Inn Express and Courtyard by Marriott. These brands had reasonably healthy returns both before and during the recent economic downturn.

By contrast, during the late 1990s the superluxury business segment attracted a flood of new entrants ranging from independent boutique hotels to companies such as Starwood Hotels & Resorts Worldwide and Marriott, which expanded their St. Regis and Ritz-Carlton brands, respectively. While many of the hotels briefly filled their rooms at stratospheric rates, revenue per available room in this segment has fallen more than twice as fast as the industry average during the economic downturn. Distinguishing between cyclical effects and long-term trends might have limited the carnage.

Building the brand

Once marketers have their eye on the most promising future segments, they must rethink the brand—an increasingly complex process. Brand proliferation and rapid imitation have diminished the return on clever advertising and "breakthrough ideas," such as adding a "miracle ingredient" to a detergent or associating a sports star with a particular brand of athletic shoes. Today, cost-effective brand building depends on knowing precisely what consumers care about and tailoring the brand accordingly. Sophisticated new analytic approaches provide the precision but only when coupled with conceptual clarity in first defining a brand and then actually delivering it through a variety of what marketers call "touchpoints," the sites where consumers interact with it.

What’s my brand, anyway?

Defining a brand involves emphasizing its key benefits and attributes for consumers. To do so, marketers must recognize that a brand consists of more than a bundle of tangible, functional attributes; its intangible, emotional benefits, along with its "identity," frequently serve as the basis for long-term competitive differentiation and sustained loyalty. Coca-Cola, for example, is a powerful global brand not just because the beverage comes in a familiar red can and customers like the taste but also because it conveys an image as an optimistic, American product.

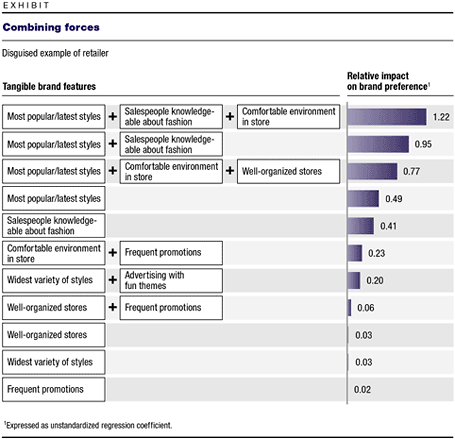

Marketers could promote many tangible and intangible brand attributes, but the goal is to uncover the relevance of each to consumers and the degree to which it helps distinguish the brand from those of competitors. The number of brand elements at play and the interdependencies that often exist between tangible and intangible attributes can make these assessments complex. Fortunately, statistical techniques can now increase their reliability. As such an analysis often shows, certain features may differentiate a brand from its competitors but don’t matter to customers. These attributes are the fool’s gold of branding.

Some attributes, however, are important even though customers expect them from any competitor. We call them "antes," after the small payments poker players make to receive cards from the dealer. In the hotel industry, for example, Holiday Inn Express seeks to provide clean, fresh, comfortable facilities, and Four Seasons Hotels and Resorts tries to offer all the business services its customers might need. These antes aren’t the centerpiece of either brand, because they don’t distinguish the players from other competitors. Nonetheless, such basic brand benefits can’t be ignored: a value establishment won’t last long if it offers dirty rooms or uncomfortable beds, nor would a luxury business hotel’s brand remain credible without fax and Internet facilities.

The most successful brands emphasize features that are both important to consumers and quite differentiated from those of competitors (Exhibit 2). We refer to these features as "brand drivers." Holiday Inn Express hopes to distinguish itself by providing customers with the emotional benefit of feeling like "a smarter business traveler" and attempts to convey a brand personality that is "fun," even a bit "wacky." For the road warrior whose expense limit has been cut, an opportunity to be "smarter" and "fun," not just cheaper, is attractive. Further up the price scale, Westin Hotels & Resorts is trying to differentiate itself from Hilton, Marriott, and Sheraton by claiming to offer "serenity and efficiency." Among higher-end customers, the Four Seasons seeks to distinguish itself by providing what it calls an "escape from the ordinary" and a personality of "calm sophistication."

Which touchpoints matter?

With the brand antes and drivers defined, a critical issue remains: how to deliver them cost-effectively. Brands are delivered at touchpoints, which for a hotel include reservations, check-in and checkout, frequent-stay programs, room service, business services, exercise facilities, laundry service, restaurants, and bars. Holiday Inn Express delivers its "smarter" and "fun" brand through touchpoints such as quality breakfasts, assurances that its on-line rates are the lowest publicly available, and zany advertising. Westin provides "serenity" for business travelers with its Heavenly Bed. And the Four Seasons relies on personal touches, such as a staff that always addresses guests by name, higher-powered employees who understand the needs of sophisticated business travelers, and at least one best-in-region facility, such as a premier restaurant or spa.

Trade-offs are possible. Airlines, for example, are unlikely to differentiate themselves for business travelers through easily imitated benefits such as better food and wine or portable DVD players. More durable brand delivery mechanisms are costlier. British Airways, for instance, redesigned its cabins to offer the first flat beds in business class when other airlines merely increased the pitch or width of their seats. Virgin Atlantic Airways reinforced its famous "doing things differently" brand personality with a restyled "Upper Class" service that features "designer-styled" cabins, a sit-down bar, an in-flight massage service, and flat-bed seats. Deciding whether such expensive initiatives are worthwhile requires an understanding of their potential returns, and the quantitative tools now available to marketers can help with this too.

Delivering on touchpoints involves a concerted, creative effort throughout the organization. Companies may even have to develop operational targets to help build their brands. If an airline, for instance, decided that the most cost-effective way to deliver a "considerate" brand was to speed up its check-in and security-clearance procedures, it might strive for performance levels dramatically exceeding those of competitors—for example, a two-minute check-in and a five-minute security clearance.

Persuading other parts of the organization to play along is often more difficult for marketers than exercising their creativity and planning a brand’s advertising, sponsorship, and promotion. Fortunately, analytic approaches can help marketers make their case by dramatically increasing the likelihood that they will put forward the right proposals.

Getting rid of guesswork

Recognizing antes, drivers, and touchpoints is difficult enough in retrospect. How should companies choose the right ones prospectively?

Traditionally, the elements that deliver a brand’s value to the consumer have been identified through costly trial and error. The process involves posing direct questions about a brand’s functional benefits, analyzing the results through techniques such as conjoint analysis, and then taking a series of creative leaps that qualitative research may not validate. Although this approach has been useful over the years, its functional focus runs the risk of overlooking a brand’s subtler, intangible dimensions. Traditional techniques are also ill equipped to identify with precision the relationship between a brand’s attributes and the most cost-effective touchpoints for delivering them. Finally, the experimentation that is part and parcel of traditional techniques can have the unintended consequence of confusing consumers by emphasizing first one set of brand attributes, then another.

Today, marketers can eliminate much of the guesswork by applying social-science techniques to identify the underlying brand attributes driving loyalty among specific customers. Known as pathway (or structural-equation) modeling, these techniques aren’t new; they rely heavily on fundamental regression techniques. But they are only now beginning to be applied to branding as marketers become more and more aware that targeting precisely what customers care about is the core of efficient brand building. Developing this understanding is possible today because of the information boom generated by diverse factors (such as loyalty programs, cheaper Internet-based consumer surveys, and electronic point-of-sale data) and by attitude-based research from third-party research firms as well as the availability of increasingly sophisticated and accessible data-analysis packages.

Investing in analysis

The first step is to conduct consumer research: developing questionnaires that probe as many as 250 tangible and intangible brand attributes, asking consumers to rate the brand and its competitors on each dimension, and then quantitatively linking these dimensions to the consumers’ overall loyalty. Three features distinguish this approach from traditional methodologies such as focus group-based qualitative research and conjoint analysis. First, the specificity and breadth of the questions help marketers understand the brand’s tangible and intangible benefits in great detail. Second, the analysis shows marketers the relationships among each of the brand’s elements—nuances that conjoint techniques can’t provide. Finally, rather than trying to determine the importance of individual elements, the new approach pins down their contribution to brand loyalty—which is significant, because what people say and what they do can be at odds. Whereas traditional methods might reveal that hotel customers have a broad interest in reliable business services or comfortable in-room amenities, the new techniques make it possible to uncover the core need (such as "a hotel that makes me feel like I am at home while I am away") underlying these desires. Meeting such needs is the essence of building an effective brand.

Completing the core consumer research and analysis helps pinpoint the most effective combination of touchpoints that will deliver the brand’s value proposition. The key is determining which touchpoints correlate best with the brand’s essence (that is, which "make me feel special") and then assessing the statistical relationship between the touchpoints themselves to arrive at the groupings that correlate best with the desired brand positioning (see sidebar, "Behind the math"). This analysis often highlights instances in which the whole is greater than the sum of the parts. Combining a strong frequent-guest program with fast check-in and checkout procedures, for example, might have the strongest collective correlation with a given hotel’s brand proposition, even if rapid room service and high-speed Internet connections had stronger individual associations with the brand.

The payoff

As complex as pathway modeling may sound, it should make the eyes of marketers light up because it allows them to quantify the potential impact of brand initiatives on customer loyalty, which can be translated into dollars and cents. When compared with likely costs, these forecasts let marketers make rough estimates of the return on their branding investments.

Such estimates simplify the process of making touchpoint trade-offs. Consider the plight of an airline that targets frequent business travelers and wants to be seen as "more considerate." At least 20 customer-care touchpoints can be identified, including faster check-in, higher checked-baggage allowances, more upgrades, more extras onboard, and more frequent-flyer miles. Without careful targeting, the airline could squander resources on the wrong one. Techniques such as pathway modeling can also identify touchpoint conflicts. A Canadian food service company turned to cash-only transactions at its drive-throughs when it found that speed was of the highest importance to customers—debit cards (previously thought to be a high-priority touchpoint) were slowing things down.

The businesses pioneering these techniques are achieving impressive results. For example, a pharmaceutical company that understood which physicians were prescribing what products, but not exactly why, discovered the brand attributes that would be most likely to influence prescription-writing patterns. It did so by surveying more than 2,000 physicians around the world about more than 150 tangible and intangible brand dimensions—a huge leap forward from the simple, functionally oriented surveys it had previously used. In the brand’s first year of repositioning, sales increased by more than 10 percent. An industrial company that used the techniques to overhaul its go-to-market strategy generated $200 million in new sales. And a specialty retailer boosted same-store sales by 2 percent within three months of refining the way it appealed to loyal customers.

Ensuring success

Pinpointing the attributes that distinguish a brand and the touchpoints through which they should be delivered isn’t just a quantitative exercise. After all, if a questionnaire doesn’t ask about a potential brand attribute, it won’t show up in customer responses. Relevant input from everyone—senior executives to brand managers and sales representatives to advertising people—is therefore vital. Broad involvement can create issues of its own: in designing research the dice can certainly be loaded for or against an executive’s pet theory. Senior leaders can play an important role by calling for a level playing field that allows the research to settle disputes in a fact-based way rather than perpetuating them.

Marketers can increase their chances of success by investing heavily to communicate their analyses internally and to show their colleagues why these analyses support proposed initiatives. Pathway modeling can easily sound quite academic; the challenge is to present its conclusions in a way that senior leaders who aren’t marketers can understand and believe. Armed with conviction, the CEO and the business-unit heads can become the chief brand advocates in their organizations—crucial in a world where brand building depends not just on a catchy jingle but on the whole company.

Companies can build better brands for less money with a forward-looking segmentation and sophisticated analytic tools that increase the precision of defining and delivering a brand. This approach requires an open mind and persistence, but it beats placing bets that may not deliver.