Your supply chains generate big data. Big supply-chain analytics turn that data into real insights.

The explosive impact of e-commerce on traditional brick and mortar retailers is just one notable example of the data-driven revolution that is sweeping many industries and business functions today. Few companies, however, have been able to apply to the same degree the "big analytics" techniques that could transform the way they define and manage their supply chains.

In our view, the full impact of big data in the supply chain is restrained by two major challenges. First, there is a lack of capabilities. Supply chain managers—even those with a high degree of technical skill—have little or no experience with the data analysis techniques used by data scientists. As a result, they often lack the vision to see what might be possible with big data analytics. Second (and perhaps more significantly), most companies lack a structured process to explore, evaluate and capture big data opportunities in their supply chains.

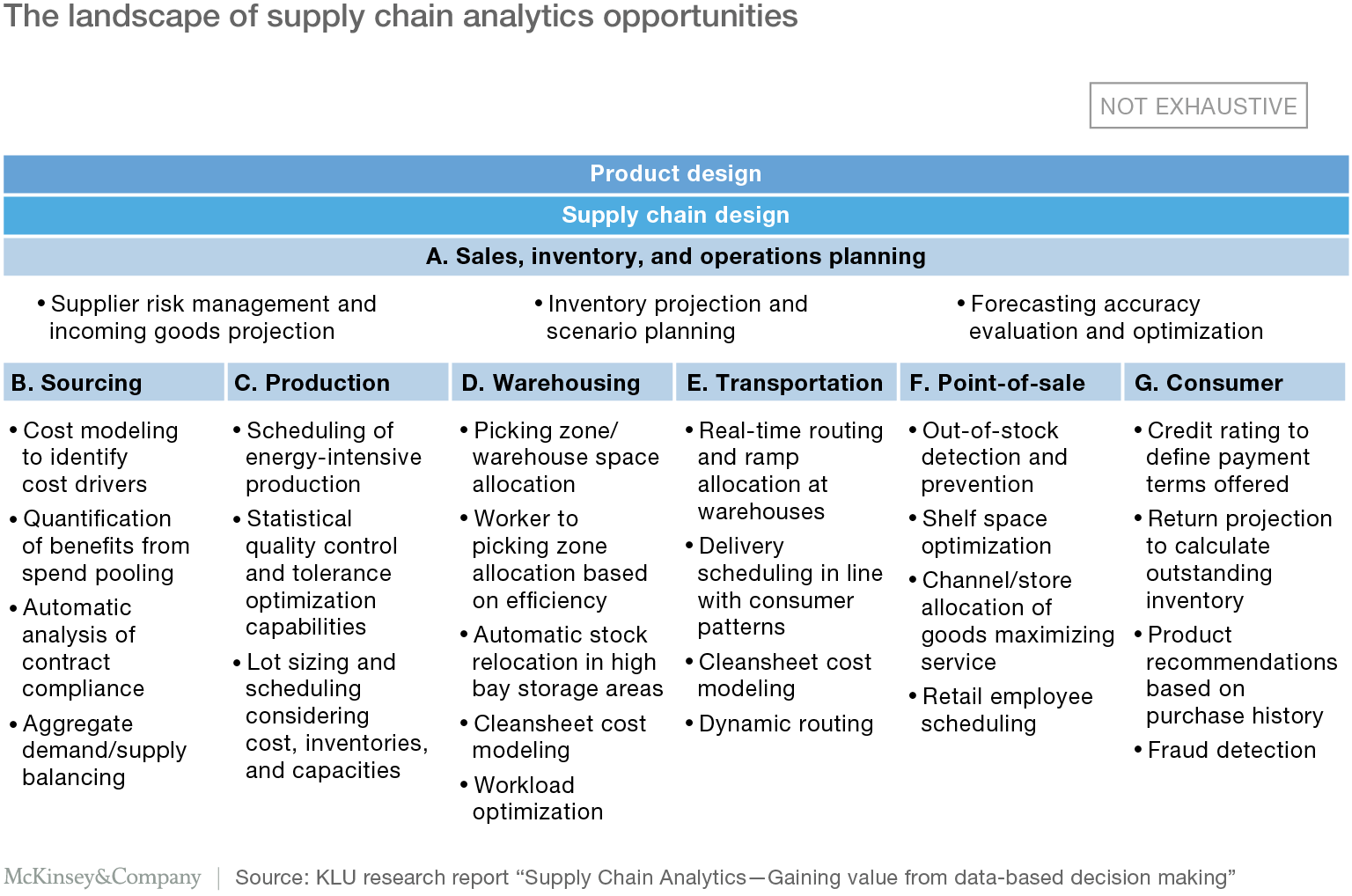

In the second part of this article series, we will show how companies can take control of the big data opportunity with a systematic approach. Here, we will look at the nature of that opportunity and at how some companies have managed to embed data driven methodologies into their DNA. Exhibit 1 provides an overview of the landscape of supply chain analytics opportunities.

What is big supply-chain analytics?

Big supply chain analytics uses data and quantitative methods to improve decision making for all activities across the supply chain. In particular, it does two new things. First, it expands the dataset for analysis beyond the traditional internal data held on Enterprise Resource Planning (ERP) and supply chain management (SCM) systems. Second, it applies powerful statistical methods to both new and existing data sources. This creates new insights that help improve supply chain decision-making, all the way from the improvement of front-line operations, to strategic choices, such as the selection of the right supply chain operating models.

Let's look at each main area in turn.

A. Sales, Inventory and Operations Planning

Typically, planning is already the most data-driven process in the supply chain, using a wide range of inputs from Enterprise Resource Planning (ERP) and SCM planning tools. There is now significant potential to truly redefine the planning process, however, using new internal and external data sources to make real-time demand and supply shaping a reality.

We can think about managing inventory in a supply chain similar to the way electricity is managed: Storing electricity is expensive and difficult; power companies bring in additional consumers or start and stop plants to ensure a balanced power grid. Retailers now have the opportunity to use a similar approach. Visibility of point of sale (POS) data, inventory data, and production volumes can be analyzed in real time to identify mismatches between supply and demand. These can then drive actions, like price changes, the timing of promotions or the addition of new lines, to realign things.

Retailers can also use new data sources to improve planning processes and their demand-sensing capabilities. For example, Blue Yonder has developed data intensive forecasting methods now deployed into retailing where 130,000 SKUs and 200 influencing variables generate 150,000,000 probability distributions every day. This has dramatically increased forecast accuracy; enabled a better view of the company's logistics capacity needs; and reduced obsolescence, inventory levels, and stockouts. The recent growth of third party cloud-based services like Blue Yonder is making such activities more accessible for other retailers, too.

Similarly, IBM has helped develop links between production planning and weather forecasts for bakeries. By incorporating temperature and sunshine data, baking companies are able to more accurately predict demand for different product categories based on factors that influence consumer preferences. Amazon, meanwhile, has patented an "anticipatory shipping" approach, in which orders are packaged and pushed into the delivery network before customers have actually ordered them.

Having truly mastered big-data forecasting, the next level of sophistication is to start actively shaping demand. Leading online retailers, for example, use big data analytics, inventory data, and forecasting to change the products recommended to customers. This effectively steers demand towards items that are available in stock.

B. Sourcing

In many companies, data on procurement volumes and suppliers are only gathered for few activities in the sourcing process. However, supply data goes beyond the classic spend analysis and annual supplier performance review. On a transactional basis, supply processes can be sensed in real time to identify deviations from normal delivery patterns. Firms are also finding opportunities for predictive risk management. By mapping its supply chains and using "Google trend"-style information and social data about strikes, fires, or bankruptcies, a firm can monitor supply disruptions in transportation, or at 2nd or 3rd tier suppliers, and take decisive actions before its competitors.

Data analysis can also drive strategic decisions. In recent years, one pharmaceutical company has created a database with all bids submitted for packaging. The data has been evaluated to fully understand the cost structure of those suppliers and to create detailed cost models for different types of packaging. Using updated information on commodity prices, factor costs, and plant utilization, these models can be used to aid the selection of the most appropriate suppliers for new packaging projects. Similarly, Caterpillar has initiated a contest on the crowd-data science website Kaggle to model quoted prices for industrial tube assemblies.

These "clean sheet costing" bottom-up calculations can also be applied in the purchase of transportation and warehousing. By exploiting data on the cost breakdown of operations of trucks and warehouses across the globe, companies do create a powerful fact base to challenge carriers and Logistics Solution Providers (LSPs), and provide real insight into "should cost" during negotiations.

C. Manufacturing

Big data and analytics can already help improve manufacturing. For example, energy-intensive production runs can be scheduled to take advantage of fluctuating electricity prices. Data on manufacturing parameters, like the forces used in assembly operations or dimensional differences between parts, can be archived and analyzed to support the root-cause analysis of defects, even if they occur years later. Agricultural seed processors and manufacturers analyze the quality of their products with different types of cameras in real-time to get the quality assessments for each individual seed.

The Internet of Things, with its networks of cameras and sensors on millions of devices, may enable other manufacturing opportunities in the future. Ultimately, live information on a machine's condition could trigger production of a 3D-printed spare part that is then shipped by a drone to the plant to meet an engineer, who may use augmented reality glasses for guidance while replacing the part.

D. Warehousing

Logistics has traditionally been very cost-focused, and companies have happily invested in technologies that provide competitive advantage. Warehousing in particular has seen many advances using available ERP data. One example are "chaotic" storage approaches that enable the efficient use of warehouse space and minimize travel distances for personnel. Another are high-rack bay warehouses that can automatically reshuffle pallets at night to optimize schedules for the next day. Companies can track the performance of pickers in different picking areas to optimize future staff allocation.

New technologies, data sources and analytical techniques are also creating new opportunities in warehousing. A leading forklift provider is looking into how the forklift truck can act as a big data hub that collects all sorts of data in real time, which can then be blended with ERP and Warehouse Management System (WMS) data to identify additional waste in the warehouse process. For example, the analysis of video images collected by automated guided vehicles, along with sensor inputs including temperature, shelf weight, and the weight on the forklift, can be used to monitor picking accuracy, warehouse productivity and inventory accuracy in real time. Similarly forklift driving behavior and route choices can be assessed and dynamically optimized to drive picking productivity. The data can also be used to conduct root-cause analysis of picking errors by shape, color, or weight, to help to make processes more robust.

New 3D modelling technologies can also help to optimize warehouse design and simulate new configurations of existing warehouse space to further improve storage efficiency and picking productivity. German company Logivations, for example, offers a cloud-based 3D warehouse layout planning and optimization tool.

E. Transportation

Truck companies already make use of analytics to improve their operations. For example, they use fuel consumption analytics to improve driving efficiency; and they use GPS technologies to reduce waiting times by allocating warehouse bays in real time.

Courier companies have started real-time routing of deliveries to customers based on their truck's geo-location and traffic data. UPS, for example has spent ten years developing its On-Road Integrated Optimization and Navigation system (Orion) to optimize the 55,000 routes in the network. The company's CEO David Abney says the new system will save the company $300 million to $400 million a year.

Big analytics will also enable logistics providers to deliver parcels with fewer delivery attempts, by allowing them to mine their data to predict when a particular customer is more likely to be at home. On a more strategic basis, companies can cut costs and carbon emissions by selecting the right transport modes. A major CPG player is investing in analytics that will help it to understand when goods need be shipped rapidly by truck or when there is time for slower barge or train delivery.

F. Point of Sale

Brick and mortar retailers—often under heavy pressure from online competitors that have mastered analytics—have understood how datadriven optimization can provide them with competitive advantages. These techniques are being used today for activities like shelf-space optimization and mark-down pricing. Advanced analytics can also help retailers decide which products to put in high value locations, like aisle ends, and how long to keep them there. It can also enable them to explore the sales benefits achieved by clustering related products together.

Search engine giant Google has acquired Skybox, a provider of highresolution satellite imagery, that can be used to track cars in the car park in order to anticipate in-store demand. Others have explored the use of drones equipped with cameras to monitor on-shelf inventory levels.

A topic that is still a challenge for many retailers is out-of-stock detection and prevention. In developed markets, manual inspections are expensive, while RFID tags still cost too much to be applied to individual grocery items. Instead, retailers are now monitoring sales activity for out of stock indicators. If an item that usually sold every few minutes does not appear at the tills, an alert is triggered to have person check if the item is out of stock at the shelf. Other innovative technologies are also being tested, including the installation of light or weight sensors on shelves as well as the use of in-store cameras to monitor on-shelf stock levels.

Similar technologies can be applied directly at the point of use. Amazon's Dash service, for example provides consumers with wireless buttons that can be used to reorder domestic products with a single push, like washing powder or razor blades. Ultimately, stores may be able to link to data gathered from consumer's Internet-connected refrigerators to forecast demand in real time.

As the examples in this article show, big data is already helping leading organizations transform the performance of their supply chains. Today, such approaches are the exception rather than the norm, however. Lack of capabilities and the lack of a structured approach to supply chain big data is holding many companies back. For big data and advanced analytical tools to deliver greater benefits for more companies, those organizations need a more systematic approach to their adoption. Part 2 of this series will address that topic in detail.

About the authors: Knut Alicke is a master expert in the Stuttgart office, Christoph Glatzel is a director in the Cologne office, and Per-Magnus Karlsson is a consultant in the Stockholm office. Kai Hoberg is an associate professor of supply chain and operations strategy at Kühne Logistics University, Germany.