Mergers and acquisitions (M&A) frequently drive growth in the engineering-and-construction (E&C) sector. In fact, M&A growth usually outpaces organic growth, except in some niche sectors. But even though E&C companies frequently acquire other companies, many companies, surprisingly, face significant integration challenges, particularly compared with other industries (Exhibit 1).

A smooth, successful merger is challenging in any industry, but some challenges are intensified in an E&C context, in which serial acquisitions are becoming more common. For example, integrating two companies into one common operating model is itself a significant hurdle. But it is particularly complex in E&C because the frequency of mergers means many companies are attempting to integrate multiple operating models at the same time.

The hurdles created by frequent mergers are exacerbated by their relative size. Recent years have seen more consolidation of large, multinational companies, as compared with the acquisition of smaller, more boutique companies. It has become increasingly common for a company to acquire a company of comparable size and reach. For a $12 billion E&C company, integrating a small, localized operation of 80 to 100 engineers is relatively simple; integrating a $6 billion operation with a staff of 20,000 across three regions is exponentially harder.

The consequences of these challenges are real. Often, they result in a limited ability to capture full value of the acquisition, and they present a flight risk for talent. Talent loss can be a lethal blow in an industry with no tangible assets and already-slim margins. Not only does it drain an E&C company of its most important resource, it also feeds that talent into competing companies, strengthening their offerings.

Industry consolidation through M&A will persist, if not grow, making it critical for leaders to address these issues. M&A-deal volumes have continued apace over the past four years, peaking in 2015 with $205 billion in transactions. And 2017 was only 10 percent below that peak. In addition, deals are growing in size, which creates complexity (Exhibit 2). In 2017, the industry saw multiple transactions of more than $1 billion in value, including SNC-Lavalin’s $2.7 billion acquisition of WS Atkins and Jacobs Engineering’s $3.3 billion acquisition of CH2M.

For E&C companies to succeed, they should implement a rigorous approach to integration, starting well before day one. Successful integrations depend on ensuring business continuity, creating a truly new entity, and capturing value. The strongest integration teams possess long-term capabilities to address the following actions:

- Focus on culture.

- Build distinctive internal capabilities.

- Accelerate value capture.

1. Focus on culture

Culture is difficult to measure quantifiably but essential to address in M&A. The wide range of services and corporate environments across the E&C industry can mean a large disparity in culture between two companies. Merging companies with different cultures and management practices often leads to organizational factions, talent loss, and value leakage. In E&C, in which a company’s primary assets are its talent and human capital, this is a critical risk. Yet in our observation, E&C leaders are frequently more focused on integrating technical systems and processes, paying less attention to the soft issues of culture and team norms.

Solutions will prove elusive unless integration leadership prepares well ahead of time. Integration teams should take a structured approach to understand management practices—what is valued, what matters, and how work gets done—and how these practices are implemented. They should identify commonalities and differences and develop action plans to address them. One way to do this is by undertaking a culture assessment to highlight management symmetries and asymmetries (Exhibit 3).

When two international E&C companies merged, employees were surprised to discover more similarities than initially expected—for instance, similar approaches to project management and end-market organization. But in probing their cultures more deeply, they discovered significant differences in daily operations, from decision making (top down versus consensus based) to accountability (individual versus group based). To address this, leaders of the new merged entity conducted a full-day working session to define a new accountability model and an action plan to roll out the model across the organization. This action plan was subsequently reviewed by leaders on a monthly basis to ensure it was on track.

Once leadership teams have identified these symmetries and asymmetries, they should take the following steps:

- Set the long-term vision. Leaders must define the new company’s culture and aspirations based on existing baselines, industry context, and strategic fit. This vision should be supported by a new action plan for implementation and key supportive management practices.

- Identify critical differences—but preserve what matters. Once leaders identify differences, they should determine which ones really lead to potential value loss. They should align on what the new management practice ought to be and then launch a thoughtful change-management program that helps the organization transition to the “new normal.” It’s important, however, to retain some of the essence of the acquired company. Endeavor to understand its culture and keep a laser-like focus on those management practices that contribute positively to the bottom line.

- Be explicit about expectations. Change must happen, but knowledge mitigates fear. Inform everyone as to how the culture will change with respect to both process and content. Be direct and clear about expectations and the new entity’s culture. Create a dedicated workstream that centers on avoiding employee departures that could result in the loss of critical customers.

2. Build distinctive internal capabilities

With culture on the right track, leaders must focus on empowering their most talented people to succeed postmerger. Those overseeing larger integrations should consider creating an integration-management office (IMO), a dedicated entity tasked with implementing the new operating model and delivering the value of the deal. Populated with top performers, the IMO is accountable for delivering full impact across six critical workstreams: master planning, value capture, organizational design and talent, culture, communications, and technology. (For more on setting up the organization for success, see sidebar, “Redesigning the engineering-and-construction operating model.”)

The specific architecture of each IMO will vary depending on factors such as deal structure, the amount of time between the deal’s announcement and close, and the relative size difference between both companies. Regardless, best-in-class IMOs are set up to support successful integration through the following qualities:

- Clear mandates and roles. The IMO should be a powerful, sanctioned vehicle for delivering timely impact across geographies, functions, and business units while ensuring minimal burden on the overall business. Its mission and mandate must be clearly communicated throughout the organization.

- Strong leadership. The IMO should be led by a senior business leader with direct access to the CEO. This leader should be fully dedicated to the integration, with performance incentives linked to successful outcomes.

- Continuous connectivity with key stakeholders. Successful IMOs may involve leaders from both the acquirers and acquired companies, who should align early on their decision-making processes and working models.

3. Accelerate value capture

A well-organized new entity, led by capable people and aligned around the same vision, is primed to secure some quick wins through accelerated value capture. The time between announcement and deal close is crucial, and companies that use this time prudently can accelerate the integration process. In our observation, companies that complete integration within two years deliver 40 percent more total returns to shareholders than those that integrate within four years.

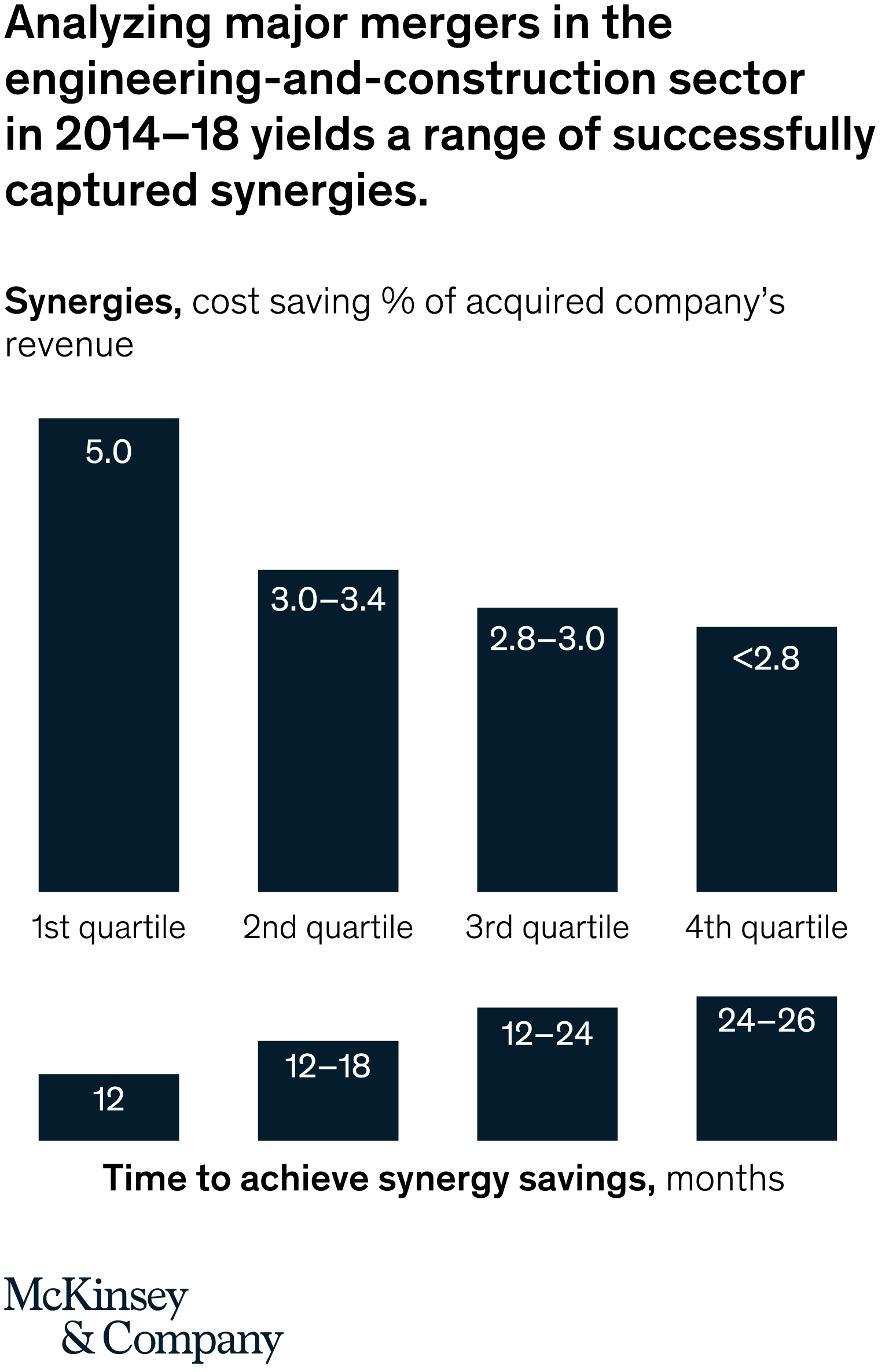

Naturally, many factors affect the acceleration of the integration process. Additionally, value-capture drivers vary for each integration, depending on the deal rationale. But identifying and optimizing synergies can be helpful in accelerating integration. Recent E&C deals have targeted synergies between 2.2 and 5 percent of the acquired company’s revenue in the 18 to 24 months following deal close (Exhibit 4).

In addition, synergies in E&C integrations are typically described in two ways: combinational synergies, which emerge immediately due to overlap, and transformational synergies, which are unlocked over time by the new operating model. Combinational synergies might include the consolidation of indirect procurement by leveraging higher volumes. Transformational synergies might include the new, integrated value proposition of the combined companies or the optimization of support functions.

Integrating companies should identify and exploit synergies where possible and when advantageous. But the following steps can accelerate integration in virtually any M&A process:

- Establish a value-protection team to manage risk on large projects and programs. To maintain stability, leaders should create a dedicated team to track, monitor, and mitigate risks in the acquired company’s backlog. This team should be expressly focused on key business processes, not integration efforts. For instance, it can scan for large projects with fixed-price components (and thus riskier profiles), multiyear programs with larger cash-flow effects, or projects with ongoing disputes that may compromise margins.

- Pursue savings through consolidation. Quick consolidation of costs can help realize rapid savings. One avenue for this is real estate. It is not unusual for E&C companies to have many small offices in and around a single city, often due to prior mergers that did not result in real-estate closures. Some practical measures might be consolidating unneeded offices where there is footprint overlap, implementing coworking solutions for roles that spend more time out in the field than in the office, and shifting functions to low-cost locations, where possible. In one E&C merger, leaders exceeded their synergy targets by aggressively shifting construction-drawing services and clusters of engineering calculations to low-cost locations.

- Launch a client-relationship team. The client-relationship team should rapidly engage key clients, explaining the acquisition and how the new company will better serve their needs. This team also has the opportunity—through these client conversations—to identify and evaluate cross-selling opportunities, develop key account plans for important clients, and focus on bids or projects that will demonstrate the value of the new operating model. As part of its mandate, the team can also help resolve any challenges arising from the acquirer and the target being on conflicting sides of a similar project.

Integration acceleration serves another important purpose—demonstrating the capacity to deliver on the original deal rationale. For example, two engineering companies decided to join forces to provide the market with a new joint-value proposition, building their competitive advantage. The two companies assembled a task force charged with the singular responsibility of responding to bids from day one onward. Led by a high performer and reporting directly to the global business-unit leader, the task force won, within the first six months, a new multibillion, multiyear contract based on the new joint-value proposition. This sent a strong message justifying the original deal.

M&A has proved to be a sustained growth source for E&C companies. But for true capture of promised value, companies must conduct every integration with rigor, focus, talent, and a comprehensive approach to rapid value capture. Any E&C company aspiring to use M&A as a growth driver must create strong internal capabilities, recognize and deploy best practices, and profit from lessons learned in past integrations to achieve operational success.