Is there a reliable way for industries to increase their profitability while reducing their dependence on natural resources? In recent years, McKinsey research has shown that the circular economy—using and reusing natural capital as efficiently as possible and finding value throughout the life cycles of finished products—is at least part of the answer.1 In 2015, as part of a major study with the Ellen MacArthur Foundation, we demonstrated that such an approach could boost Europe’s resource productivity by 3 percent by 2030, generating cost savings of €600 billion a year and €1.8 trillion more in other economic benefits.

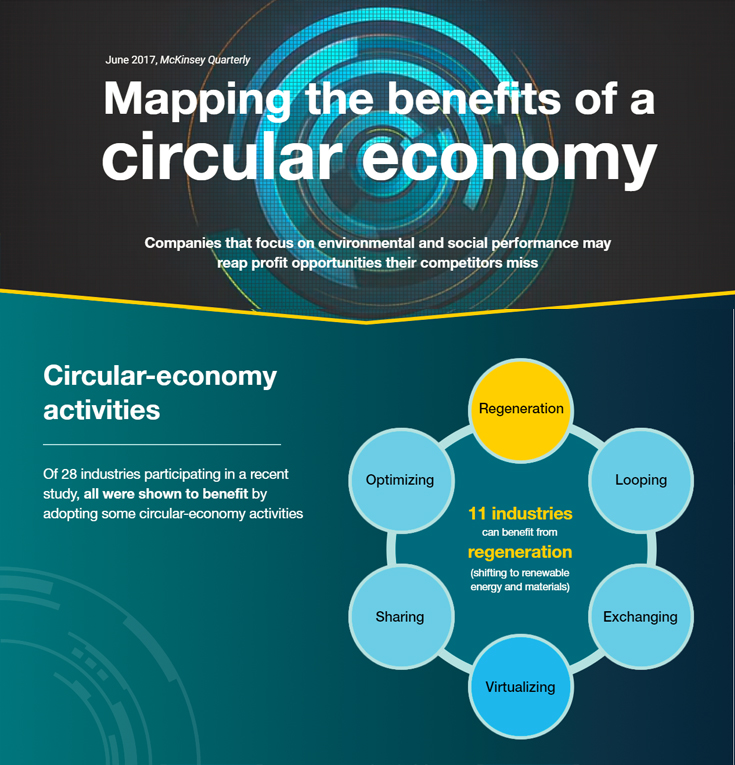

Exhibit 1 shows that most of the 28 industries we studied could adopt three to four of six potential circular-economy activities, improving performance and reducing costs accordingly. These are shifting to renewable energy and materials (Regenerate), promoting the sharing of products or otherwise prolonging product life spans through maintenance and design (Share), improving product efficiency and removing waste from supply chains (Optimize), keeping components and materials in “closed loops” through remanufacturing and recycling (Loop), delivering goods and services virtually (Virtualize), and replacing old materials with advanced renewable ones or applying new technologies such as 3-D printing (Exchange). Most industries already have profitable opportunities in each area.

In the sections that follow, we explore how leaders are putting these principles to work in three short case studies covering emerging markets and specific industries.

For additional research on the circular economy, see “Finding growth within: A new framework for Europe,” in The circular economy: Moving from theory to practice, McKinsey Center for Business and Environment, October 2016, by Morten Rossé, an associate partner in McKinsey’s Munich office, Martin Stuchtey, an alumnus and former director of the McKinsey Center for Business and Environment, and Helga Vanthournout, a senior expert in the Geneva office.

Building a business from waste

Economic growth in emerging markets has helped to raise living standards—but inevitably it has also generated massive consumer and industrial waste. Many municipalities in these markets spend up to half their budgets on solid-waste management. Innovative businesses, however, drawing on circular-economy principles, are finding ways to convert trash into income streams. By aggregating volumes substantial enough to justify business investment, they are able to create the infrastructure to organize and manage waste supply chains.

Exhibit 2 shows three opportunities and three levels of value for each. Polyethylene terephthalate bottles in mixed waste, for example, can be incinerated, but the economic payoff from the energy generated is low. Recovering the bottles’ material value, from mixed recyclables or bottle-to-bottle recycling, produces a much higher payout. Metals, meanwhile, are commonly extracted from tires in open backyard fires—at great cost to human health and the environment. Aggregating tires for use as industrial fuel, on the other hand, could increase their value almost tenfold, while crumbling them to make road-paving material yields even more. The same principle works for electronic waste: shifting from small-scale recycling to best smelting processes or liquid-chemical extraction techniques multiplies yields. Bear in mind that pound for pound, there is more gold in electronic scrap than there is in ore.

Scaling up requires management discipline. Successful programs such as the tire-recycling exchange of the Recycling and Economic Development Initiative of South Africa (REDISA) have a strong balance sheet that encourages investment by downstream waste users and the management expertise to hone operations and attract talent. They also invest in infrastructure, including IT. REDISA’s digitized product tagging improves recovery, which in turn allows manufacturers to design tires with less toxic materials.

For the full article, see “Ahead of the curve: Innovative models for waste management in emerging markets,” in The circular economy: Moving from theory to practice, McKinsey Center for Business and Environment, October 2016, by Hauke Engel, a consultant in the Frankfurt office, Martin Stuchtey, and Helga Vanthournout.

Making ‘fast fashion’ sustainable

Apparel sales have risen sharply in recent years, as businesses have used “fast fashion” design and production systems to cut prices and introduce new lines more often. From 2000 to 2014, global clothing production doubled and the number of garments sold per person increased by 60 percent. In five large developing countries—Brazil, China, India, Mexico, and Russia—sales grew eight times faster than in large advanced countries, though the average advanced-country resident still buys more clothing each year.

Narrowing that gap represents a big opportunity for clothing companies, but the environmental consequences are clear (Exhibit 3). Making and laundering clothes typically requires large quantities of water and chemicals; fiber farms occupy vast tracts of land; greenhouse-gas emissions are significant. After consumers discard old garments—something that happens ever more quickly—current technologies cannot reliably turn them into fibers for new clothes. Without improvements in how clothing is made, cared for, and disposed of, apparel’s environmental impact will worsen.

Would you like to learn more about our Sustainability & Resource Productivity Practice?

Clothing businesses are taking note. Some have formed coalitions to promote nontoxic chemicals, improve cotton farming, and raise production standards. Others are helping develop standards for garments that can be more easily reused or recycled, and investing in the development of new fibers that will lower the environmental effects of production. Using more sustainable methods may cost slightly more, but doing so can also spur innovation, guard against supply-chain shocks such as drought conditions that affect cotton supplies, and enhance corporate reputations.

For the full article, see “Style that’s sustainable: A new fast-fashion formula,” October 2016, by Nathalie Remy, a partner in the Paris office, Eveline Speelman, a consultant in the Amsterdam office, and Steven Swartz, a partner in the Southern California office.

Why supply chains hold the key

The global consumer sector is expected to grow 5 percent a year for the next two decades. But environmental and social problems pose a real threat. We estimate that more than half of the enterprise value of the top 50 consumer companies depends on their projected growth, which is vulnerable to issues such as drought, government limits on greenhouse-gas emissions, and reputational damage from insufficient attention to pollution and safety.

When managing their sustainability performance, consumer companies often start with their own operations. The largest opportunities for improvement, however, can probably be found in supply chains, which typically account for 80 percent of a consumer business’s greenhouse-gas emissions and more than 90 percent of its impact on air, land, water, and biodiversity (Exhibit 4).

Identifying sustainability challenges along the entire supply chain, then, is crucial. However, fewer than 20 percent of the 1,700 respondents to a survey by the Sustainability Consortium are doing this. Best-practice companies assist suppliers with managing sustainability impact, offering incentives for improved performance, sharing technologies that can help optimize the use of resources such as water and soil, and closely monitoring performance to be able to intervene quickly when problems arise.

For the full article, see “Starting at the source: Sustainability in supply chains,” November 2016, by Anne-Titia Bové, a specialist in the São Paulo office, and Steven Swartz.