Australian consumers are expressing a deeper need to exercise control in day-to-day life decisions, are showing more interest in the “localness” of brands, and are increasingly making purchase decisions that align with their personal values.

In this article, we look at how these emotional needs are reshaping Australian purchasing behaviour. While some needs are complementary, others are contradictory, particularly once you layer in the need for frugality, which we highlighted in our last article, “Australia's next normal: The cautious consumer.” Overall, however, our observations indicate the emergence of a more considered, more mindful, and potentially less spontaneous consumer. As a result, the bar for consumer companies to have hyperrelevant brands and invest in even more tailored and personalised touchpoints and messages has been continually increasing.

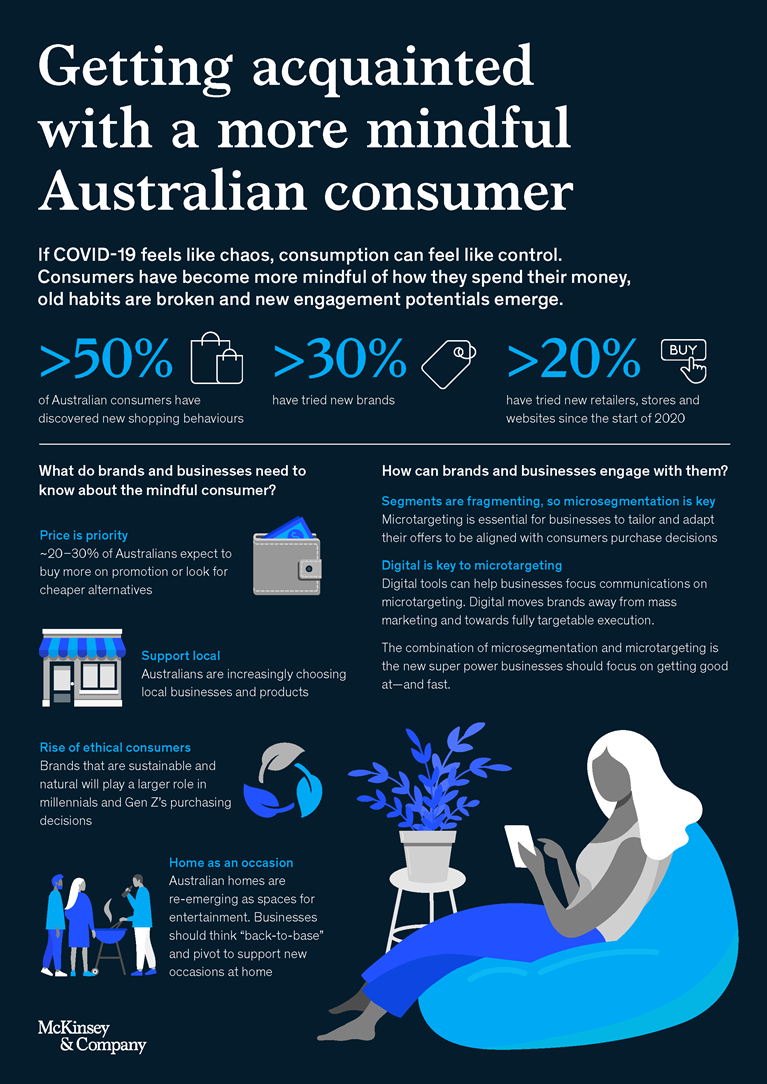

If COVID-19 feels like chaos, consumption can feel like control

In a world rife with uncertainty, consumers often strive to exert control where they can. Hence, during the current crisis, consumers report that they are making more deliberate decisions about where they go, what they do, and what they buy.

The COVID-19 experience has also led many Australians to make new or renewed commitments to their personal values and goals, such as wellness or family, and many say they are prepared to make meaningful trade-offs long after the immediate crisis passes.

Locked at home, Australians have also taken to their kitchens—cooking and fermenting from scratch, eating healthier food (or at least trying to), and making changes in the ways they source their food.

The increased mindfulness and elevated engagement levels with staples like food has translated into more planned and considered shopping. For example, the big weekly grocery shop with the well-structured shopping list written on a Friday evening is reemerging. But what is driving the choices on that list?

Yes, price is a priority ...

As we mentioned in our last article, “Australia's next normal: The cautious consumer,” 25 to 30 percent of Australians anticipate they will buy more on promotion or look for cheaper products and alternatives. And this impact is not equal across households: as compared with households that haven’t experienced a drop in income, twice as many households that have seen their income decline during the COVID-19 pandemic say they look for promotions and lower-priced products.

The focus on value and lower prices is not a new trend; rather it is accelerating and broadening in necessity, at least for now. Over the past five years, there has been a slow but steady increase in private-label consumption, especially with discounters expanding into the Australian grocery market.

Another driver in consumers’ search for value is a learned reliance on promotional intensity. Currently, Australia is one of the most highly promoted grocery markets in the world; in the past ten years, the share of grocery products sold on promotion has increased from approximately 30 percent1 to around 40 percent2 (Exhibit 1). As per a McKinsey Consumer Sentiment survey, the increase in promotional intensity has been effective in stemming the expansion of private labels but at a cost: it creates an expectation of “revolving bargains,” in which consumers prefer to wait to get their trusted brands at a better price.

In the past, we saw price sensitivity and discount scanning growing only in specific segments (for example, discount seekers who optimised everything around price). But now we are observing that even some segments that traditionally were more focused on quality or specific attributes, such as sustainability, consider price and promotion increasingly important when making purchasing decisions.

... but it’s not all about price

As mentioned, many Australians are also expressing an increase in emotional needs that go beyond price. For example, our survey reported consumers are continuing the move towards local by supporting their local neighbourhood businesses and increasingly choosing Australian brands—which could symbolise trust and security in a time of global flux. In our ethnographic research, we found that as Australians spent more time at home (at first mainly as a result of lockdowns), their awareness and support of their communities also went up, generating a corresponding uptick in interest in the smaller, more locally produced brands around them. Again, this trend isn’t new in Australia: smaller brands have captured a disproportionate share of growth over the last five years. As per a 2020 Euromonitor report, in 2019 small brands accounted for approximately 30 percent of packaged-food sales in Australia, but they contributed approximately 50 percent of packaged-food growth from 2014 to 2019 (Exhibit 2).3 We expect this trend will only accelerate in the coming years.

There is also a rising trend toward brands that are sustainable and natural (Exhibit 3). This rise of a more ethical consumer is also far from new—for millennials and Gen Z, the role of sustainability and natural materials (often at a premium price) already played a larger role in their purchase decisions than in the decisions of their older peers. Many of those premium brand segments have outpaced average growth across consumer categories for the last five years. While we are heading into more frugal times, the “barbelling” of consumer choice (between premium brands and low-priced brands) that we observed before the COVID-19 pandemic is likely to continue.

So, is ‘price’ versus ‘other attributes’ a zero-sum game?

Although some of the headwinds brands faced before the COVID-19 crisis are continuing, we have observed that during the COVID-19 outbreak, some larger mainstream brands have regained market share. As an example, Arnott’s sold four million additional packets of Tim Tam biscuits during the lockdowns.4 It could be argued, with this example in particular, that consumers were just “comfort eating” during the COVID-19 lockdowns. However, on closer look, this example is proof that multiple primary needs of consumers don’t have to be mutually exclusive. Tim Tam is a trusted brand that is local (end-to-end manufactured in Australia). This is a real-time example of consumers showing businesses that when a brand satisfies multiple needs (which may on the surface appear to be in conflict) at the same time, they are willing to find extra room in their baskets.

Therefore, although many Australians feel significantly more frugal and financially vulnerable to the economic shock of the COVID-19 crisis, we expect consumers will still be remaining steadfast in their intentions to bring values like local, small, and sustainable into their purchase decisions—denoting the arrival of a more mindful consumer. The tension between price, local, small, premium, and sustainable will probably be an ongoing “toggle” that plays out differently based on who the customer is, what the purchase is (for example, priorities for purchasing food could be different from priorities for purchasing cleaning supplies or appliances), and when the purchase is being made. With shopping and consumption becoming more and more considered over the next one to two years, using averages to represent consumer preferences will not be helpful. Consumer businesses and retailers who want to win these purchases will need to understand and anticipate how the hierarchy of decisions will play out at a granular level with their target consumer segments.

Winning with a mindful consumer

If the increasingly spontaneous consumer has departed for the time being—as have their previously “automated” routines—it is now time for consumer businesses to revisit the fundamentals and sharpen their offers to target the more considered, mindful consumer.

There are opportunities in doing so. As consumers become more mindful of how they spend their money, old habits are broken and new engagement potentials emerge. In other words, the shock to loyalty is also a shock to apathy. McKinsey’s research shows that more than 50 percent of Australian consumers have discovered new shopping behaviours, more than 30 percent have tried new brands, and more than 20 percent have tried new retailers, stores, and websites since the start of 2020. Such “forced openness” to change represents a unique opportunity to increase share for those businesses that move quickly but also represents a risk for those that don’t.

Accordingly, in this climate, we have the following advice for consumer businesses:

-

Segments are fragmenting, so microsegmentation is key. If consumers are going to be shifting their internal hierarchies of purchase decisions, then businesses need to understand that and know how to tailor and adapt their offers to capitalise on it. Safety, price sensitivity, sustainability, and a local orientation are some of the attributes that consumers have increased their focus on since the COVID-19 outbreak. But these attributes may not—and, in some cases, cannot or need not—always go hand in hand. There is a real need for consumer-facing companies to understand the hierarchy of decision making in a new world and determine, for their specific categories, the needs that matter most to different segments of consumers.

Bear in mind that existing segments (and those highlighted above) are further fractionalised in recessionary times between those consumers who are directly affected—physically, financially, or emotionally—and those consumers lucky enough not to be. That makes microtargeting essential.

-

Digital is the key to microtargeting. Successful marketing involves constantly shrinking any gap between “what you want to say” and “what they’re able to hear.” So how do consumer businesses (or their brands) show up at just the right place and time while lives, needs, and decisions are in flux? While communication is not entirely about digital, no other system offers as much potential in microtargeting as digital and social can—using these tools can help businesses focus communication on what they stand for and how it meets the needs of emerging microsegments.

Digital moves brands away from mass marketing and towards fully targetable execution. And this combination of microsegmentation and microtargeting is the new superpower businesses should focus on getting good at—and fast.

-

Home is where the hearth is. As variations of lockdowns ebb and flow—making occasions for going out less reliable or relaxing—people’s homes are taking on a social prominence not seen since the era of 1950s housewives, such as Mad Men’s Betty Draper. Shaking off a long trend towards being private cocoons, homes are reemerging as castles, if only in the sense that they are once again spaces where people entertain and, thus, project themselves socially.

This revived concept of “home as an occasion” provides businesses with a massive carte blanche to innovate and shift their brands and product portfolios. There is already a significant increase in new home occasions and a significant shift in the size of traditional occasions—with growth implications across products and services ranging from food and beverage to “vinyl revival.” Exciting consumers as they entertain at home and connect with friends and family presents a real opportunity. Therefore, businesses should think “back to base,” not “on the go,” and pivot to support, or even unlock, new occasions at home.

With the acceleration of trends combined with the change in occasions, the need to revisit and challenge current brand, product, and pack hierarchies becomes vital for brands and retailers to effectively open new demand, perform better in new channels, or solve the question of balancing price against other attributes. This is a critical part of communicating value to customers while protecting the “virtue” of brands.

For some companies, the new trends will play into their strengths, but others may require a fundamental rethink of their premises and capabilities. For businesses that have not acted on new trends in the past five years, the acceleration we are now seeing presents an unprecedented chance to make the move.