Over the past two months, the share of executives expecting troubled global markets to overwhelm domestic fundamentals has doubled, to 18 percent. This is perhaps the most telling of several findings from our most recent survey, indicating how deeply the eurozone’s financial crisis has shaken executives’ confidence in the world economy.1 Indeed, for the first time since March 2009, the executives’ confidence in the state of their own economies fell, as have their expectations for the future.

However, most see their companies’ prospects as fairly stable, if a bit less rosy than they did two months ago. A strong majority of them still expect profits to increase, and the share expecting to hire remains stable overall, at about a third—though the prospects for workers in the eurozone are markedly worse. Executives still expect low consumer spending to be the biggest threat to growth, and they are a little more worried than they were: the share expecting demand to increase has fallen back to half, the level in February, from 60 percent in April. Executives at companies in China are pursuing growth from consumers in emerging markets more keenly than are executives anywhere else.

Global economic skepticism

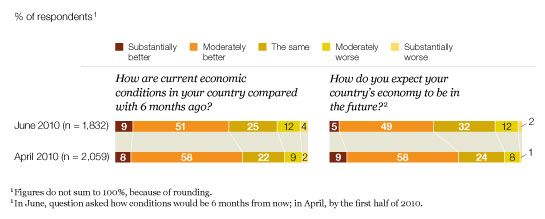

For the first time in more than a year, the share of executives with a positive view of the current and future state of their nations’ economies has fallen (Exhibit 1). Not surprisingly, executives in the eurozone are the least positive of all, with less than half—just 46 percent—expecting their nations’ economies to improve over the next six months.

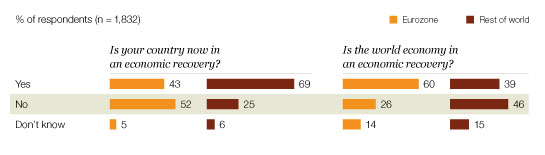

Further, though 69 percent of executives outside the eurozone say their own countries are in an economic recovery, only 39 percent of them say the same about the world economy. The relative positions are flipped among eurozone executives: only 43 percent say their countries are in recovery, but 60 percent say the world economy is (Exhibit 2). This suggests that executives around the world see the eurozone as the main source of trouble. A strong majority of all executives—79 percent—expect the euro itself to fall in value over the next three months; most expect a drop of less than 10 percent against the US dollar.

Executives’ heightened anxiety is also visible in their answers to a question about which of four scenarios will best describe the global economy by the end of 2010. The share selecting “Troubled global markets overwhelm domestic fundamentals” has doubled since April, to 18 percent. Although twice as many say “Constrained global markets perpetuate imbalances” is the best description—the same share as in April—the change suggests increasing skepticism about the fundamentals of many domestic economies.

That skepticism is further borne out by the fact that nearly three-quarters of respondents say it’s at least somewhat likely that a sovereign-debt default will harm their countries’ economies over the next 12 months. Seventeen percent say that’s very or extremely likely. Interestingly, those shares are barely higher among respondents in the eurozone.

A downturn at home

The euromess

Companies: More growth than fear

Although economic confidence is clearly shaken, more executives remain positive than negative overall, which likely explains why most expect their companies to continue growing. Although fully ten percentage points fewer now expect consumer demand to grow this year than did so in April—down to half—the same share as in April expect to hire, mostly for full-time positions. The share expecting profits to grow this year is only slightly lower, at 70 percent (Exhibit 3).

Although executives are a little less optimistic, they don’t seem to be running scared: for both profits and demand, the choice that has gained the biggest share of respondents indicates stability, not a decrease. It is also notable that for both profits and demand, the variation among regions is typical of our surveys and relatively small among developed economies. The one exception is the very low percentage of eurozone companies (39 percent) expecting demand to rise.

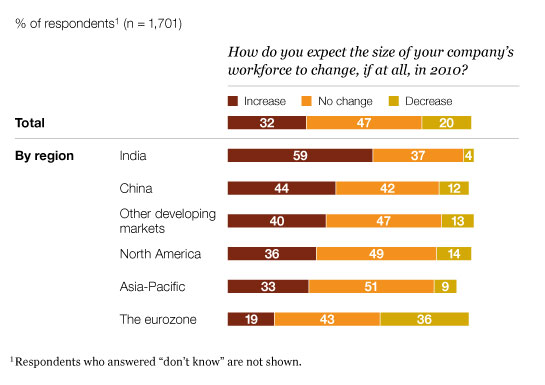

However, some unusual regional differences occur in plans for the workforce (Exhibit 4). Executives in the eurozone are more than twice as likely as those in any other region to say they expect their workforces to shrink. This finding represents a highly unusual drop and a highly unusual gap with other developed economies. In addition, executives in North America and developing markets are likelier now than in April to say their companies are planning increases, while the developed countries of Asia seem to be moving toward stability.2

The future still looks bright

Who’s hiring

The most frequently cited threats to growth in the executives’ industries are low consumer demand and economic volatility; about a third of respondents cite each. These fears may help explain why the share of executives saying that their companies will introduce new products or services in the next 12 months has dropped to 51 percent, from 57 percent, since April. That drop is, however, fairly consistent with the most frequently cited strategy for growth, chosen by 65 percent of respondents: organic growth through new customers in existing markets.

Notably, executives in China expect the same changes in consumer demand as those elsewhere but differ from almost all others in the growth strategy they choose most frequently: organic growth through new products or services.3 In addition, a higher percentage of these executives say their companies plan to reach out more to consumers in emerging markets than to other segments of customers.