Executives are increasingly positive about current economic conditions at both the global and national levels, according to our most recent survey on economic conditions.1 The future of the eurozone economy remains uncertain—60 percent expect a minimal contraction or recession there within the next six months—but, compared with three months ago, significantly larger shares of executives around the world expect improving conditions in their own countries. Concern about sovereign-debt default as a barrier to growth is down, while worries about commodity prices and geopolitical instability are up since December.

There are also positive indicators at the company level: low demand is still the most-cited risk to growth in executives’ countries, yet larger shares expect demand for their companies’ products and services to increase. Profit expectations continue their upward trend, while workforce changes and investment decisions are consistent with results from three months ago, perhaps indicating broadly that companies aren’t yet ready to move on these newly optimistic expectations.

Country expectations rebound

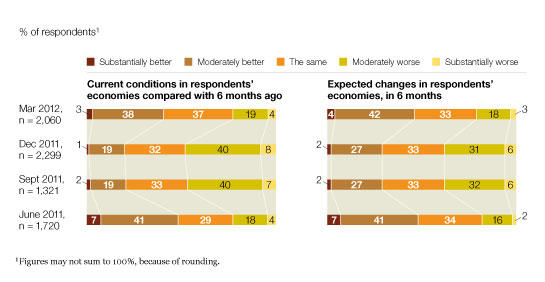

For the first time since June 2011, executives are more optimistic than pessimistic about their national economies (Exhibit 1). The share saying economic conditions in their countries are better now than six months ago has more than doubled since December, even in the eurozone, and an even larger share expect their economies will be better in six months.

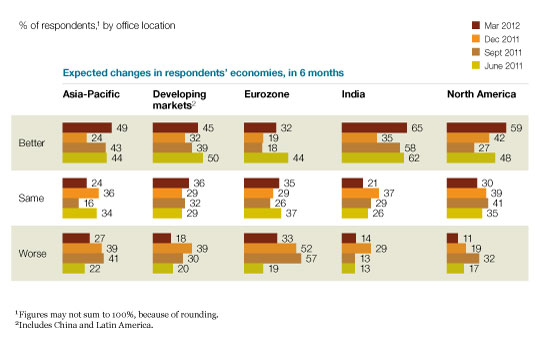

Unlike what we saw in December, expectations appear to be moving in a more consistent, upward direction across regions (Exhibit 2). Sixty-five percent of executives in India—the largest share—expect their economy to improve, while 59 percent in North America and 49 percent in developed Asia say the same.

At the regional level, expectations about unemployment vary. Respondents in North America notably have the most positive view, with 52 percent expecting the rate to decrease in the next six months. In developing markets,2 a nearly equal share expect the unemployment rate in their countries to stay the same, and only 22 percent predict a decrease.

A positive outlook

Consistent optimism

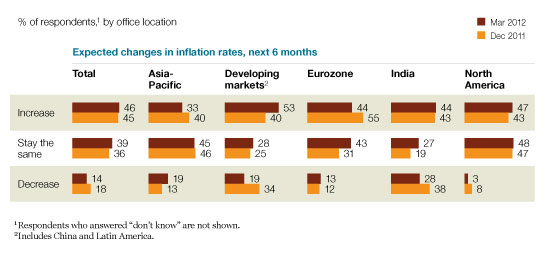

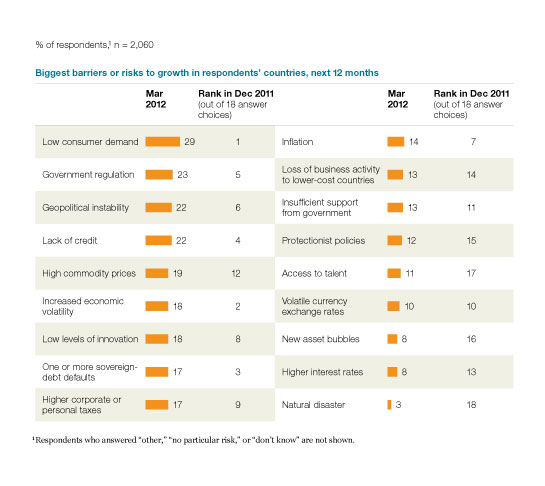

At the global level, concerns about inflation rates have held steady but differ across regions (Exhibit 3). Inflation is cited as a risk to economic growth in respondents’ countries by the same share as three months ago, yet views on other risks have shifted notably since December (Exhibit 4). Low consumer demand still tops the list but is now followed by government regulation, geopolitical instability, and lack of credit; three months ago, volatility and sovereign-debt defaults were in the top three.

Varied views on inflation

Shifting risks

Cautious global optimism

Executives’ optimism also extends to the global economy. Indeed, 42 percent say conditions are better now compared with six months ago, and 48 percent expect better conditions six months from now—up from 26 percent in December. Respondents in India report the most positive outlook on the world’s prospects, and the share in the eurozone expecting improvement climbed 17 percentage points since the previous survey.

The eurozone remains, unsurprisingly, a locus of uncertainty: 60 percent expect either a minimal contraction or recession there in six months, while only 23 percent expect at least minimal growth. When asked about potential eurozone outcomes, fewer expect either short-term or long-term integration than in December, though nearly half expect rescue packages to maintain the status quo. A larger share in Europe expect integration than do their peers in other regions.

Executives expect uncertainty in other areas, which hints that the recent optimism may still be tenuous. One area of concern is around resources: 58 percent say oil prices will be higher in six months, and a growing share (19 percent, up from 11 percent in December) cite high commodity prices as a barrier to growth. More executives also cite geopolitical instability as a barrier to growth than did three months ago; at 31 percent, it’s the barrier cited most often in North America.

Company prospects also positive

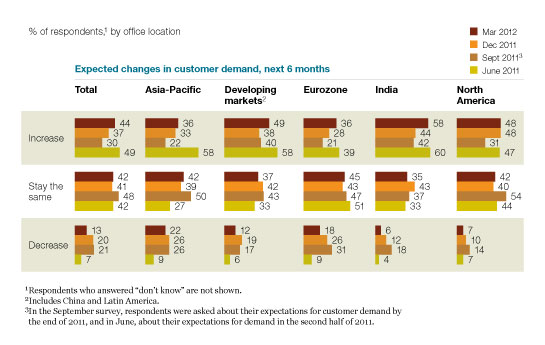

While low demand is still seen as the biggest threat to growth, more respondents expect customer demand to increase than have said so since last June (Exhibit 5), and executives are especially positive in emerging economies. The share expecting their companies’ profits to increase continues to grow: 62 percent say so now, up from 56 percent in December and 45 percent in September. As in December, executives in the eurozone are less positive about profits than elsewhere, but even their overall expectations have improved over time.3

Executives report smaller changes with respect to their companies’ hiring and investment decisions: they are still likeliest to say their workforce size will stay the same in the next six months,4 and slightly smaller shares say their companies are postponing capital investment decisions. They indicate no change since December in their companies’ willingness to pursue (or not pursue) M&A deals.5 These results also seem to reflect a cautious optimism: while executives are more positive than not on the future of the economy as a whole, their companies aren’t readier to make major strategic decisions than they were in December—or perhaps they lack confidence that conditions will improve substantively.

Demand on the rise