The COVID-19 pandemic is primarily a health crisis and a human tragedy, but it also has far-reaching economic ramifications. In Africa, it is already disrupting millions of people’s livelihoods, with disproportionate impact on poor households and small and informal businesses—and the pace of this disruption is likely to accelerate in the weeks ahead. No country or community is exempt; in oil-exporting countries, COVID-related challenges are compounded by the collapse of the oil price.

Across the continent, leaders in the public, private, and development sectors are already taking decisive action—both to save lives and to protect households, businesses, and national economies from the fallout of the pandemic. But several leaders have told us that they need a clearer picture of the potential economic impact of the crisis. At the same time, many African countries are still in the early stages of organizing their responses into focused, prioritized efforts that make the most of the limited time and resources available.

To address these needs and help inform the response of leaders across the continent, this paper presents:

- An initial analysis of COVID-19’s economic impact, which finds that Africa’s GDP growth in 2020 could be cut by three to eight percentage points. We find that the pandemic and the oil-price shock are likely to tip Africa into an economic contraction in 2020, in the absence of major fiscal stimulus.

- A framework for near-term action by governments, the private sector, and development institutions to mitigate this impact. These actions are drawn from a global scan of economic interventions already being implemented or considered, plus our recent discussions with public- and private-sector leaders across Africa.

Our message is clear. Governments, the private sector, and development institutions need to double down on their already proven resolve—and significantly expand existing efforts to safeguard economies and livelihoods across Africa.

In many countries, there is an opportunity to take bolder, more creative steps to secure supply chains of essential products, contain the health crisis, maintain the stability of financial systems, help businesses survive the crisis, and support households’ economic welfare. They also need to consider an extensive stimulus package to reverse the economic damage of the crisis.

This paper is the first in a series of rapid analyses by McKinsey, intended to provide decision makers with data and tools to strengthen their response to the COVID-19 crisis in Africa. In subsequent papers we will extend our focus beyond the immediate need for resolve to four other imperatives highlighted in our global analysis of how institutions can address the crisis—namely, resilience, return, reimagination, and reform.1

COVID-19 will greatly reduce Africa’s GDP growth in 2020

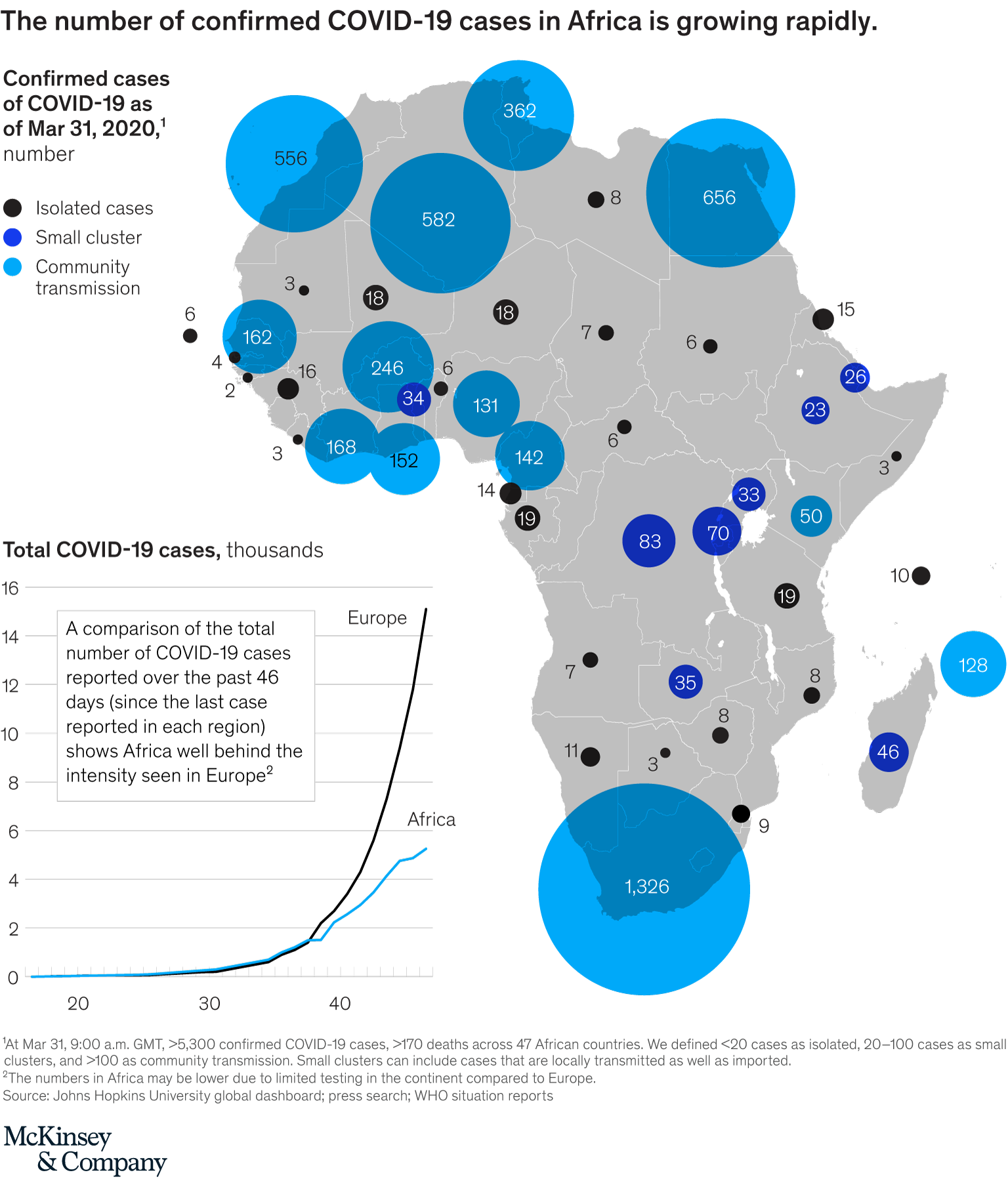

As of March 31, more than 720,000 cases of COVID-19 had been recorded worldwide, with nearly 40,000 deaths. The number of cases, and deaths, has been growing exponentially. Compared to other regions, the number of recorded cases in Africa is still relatively small, totaling about 5,300 cases across 47 African countries as of March 31 (Exhibit 1). Even though the rate of transmission in Africa to date appears to be slower than that in Europe, the pandemic could take a heavy toll across the continent if containment measures do not prove effective.

Against the backdrop of this worrying public-health situation, African countries will have to address three major economic challenges in the coming weeks and months:

- The impact of the global pandemic on African economies. This includes disruption in global supply chains exposed to inputs from Asia, Europe, and the Middle East, as well as lower demand in global markets for a wide range of African exports. Moreover, Africa is likely to experience delayed or reduced foreign direct investment (FDI) as partners from other continents redirect capital locally.

- The economic impact of the spread of the virus within Africa, and of the measures that governments are taking to stem the pandemic. Travel bans and lockdowns are not only limiting the movement of people across borders and within countries, but also disrupting ways of working for many individuals, businesses, and government agencies.

- The collapse of the oil price, driven by geopolitics as well as reduced demand in light of the pandemic. In the month of March 2020, oil prices fell by approximately 50 percent. For net oil-exporting countries, this will result in increased liquidity issues, lost tax revenues, and currency pressure. (We should note, however, that lower oil prices will potentially have a positive economic impact for oil-importing countries and consumers.)

For Africa’s economies, the implications of these challenges are far-reaching. A slowdown in overall economic growth is already being felt, and this is acute in hard-hit sectors such as tourism. Many businesses, particularly SMEs, are under significant cost pressure and face potential closure and bankruptcy. That is likely to lead to widespread job losses. At the same time, the pandemic will impact productivity across many sectors. Closures of schools and universities could create longer-term human capital issues for African economies—and could disproportionately affect girls, many of whom may not return to school. Not least, the crisis is likely to reduce household expenditure and consumption significantly.

The knock-on effects for the African public sector could be severe, in terms of reduced tax revenues and limitations on access to hard currency. African governments will face rising deficits and increased pressure on currencies. In the absence of significant fiscal stimulus packages, the combined impact of these economic, fiscal, and monetary challenges could greatly reduce Africa’s GDP growth in 2020.

Four scenarios of economic impact: Africa’s GDP growth reduced by three to eight percentage points

To gauge the possible extent of this impact, we modeled four scenarios for how differing rates of COVID-19 transmission—both globally and within Africa—would affect Africa’s economic growth. Even in the most optimistic scenario, we project that Africa’s GDP growth would be cut to just 0.4 percent in 2020—and this scenario is looking less and less likely by the day. In all other scenarios, we project that Africa will experience an economic contraction in 2020, with its GDP growth rate falling by between five and eight percentage points (Exhibits 2 and 3).

The four scenarios are as follows:

- Scenario 1: Contained global and Africa outbreak. In this least-worst case, Africa’s average GDP growth in 2020 would be cut from 3.9 percent (the forecast prior to the crisis) to 0.4 percent. This scenario assumes that Asia experiences a continued recovery from the pandemic, and a gradual economic restart. In Africa, we assume that most countries experience isolated cases or small cluster outbreaks—but with carefully managed restrictions and a strong response, there is no widespread outbreak.

- Scenario 2: Resurgent global outbreak, Africa contained. Under this scenario, Africa’s average GDP growth in 2020 would be cut by about five percentage points, resulting in a negative growth rate of −1.4 percent. Here we assume that Europe and the United States continue to face significant outbreaks, while Asian countries face a surge of re-infection as they attempt to restart economic activity. In Africa, we assume that most countries experience small cluster outbreaks that are carefully managed.

- Scenario 3: Contained global outbreak, Africa widespread. In this scenario, Africa’s average GDP growth in 2020 would be cut by about six percentage points, resulting in a negative growth rate of −2.1 percent. This assumes that significant outbreaks occur in most major African economies, leading to a substantial economic downturn. Globally, we assume that Asia experiences a continued recovery and a gradual economic restart, while large-scale quarantines and disruptions continue in Europe and the United States.

- Scenario 4: Resurgent global outbreak, Africa widespread. In this case, Africa’s average GDP growth in 2020 would be cut by about eight percentage points, resulting in a negative growth rate of −3.9 percent. Globally, we assume that Europe and the United States continue to face significant outbreaks as China and East Asian countries face a surge of re-infection. In addition, significant outbreaks occur in most major African economies, leading to a serious economic downturn.

These scenarios do not take into account the potential effects of any fiscal stimulus packages that may be announced by African governments; these should improve the economic outlook. However, we should also note that the scenarios do not take into account currency devaluations, inflationary pressure, or recent credit ratings from Moody’s and similar bodies—which could worsen the outlook. There is no room for complacency. (For a full explanation of the methodology underlying our analysis, see the note at the end of this paper.)

Depending on the scenario, Africa’s economies could experience a loss of between $90 billion and $200 billion in 2020. Each of the three economic challenges outlined above is likely to cause large-scale disruption. The pandemic’s spread within Africa could account for just over half of this loss, driven by reduced household and business spending and travel bans. The global pandemic could account for about one-third of the total loss, driven by supply-chain disruptions, a fall-off in demand for Africa’s non-oil exports, and delay or cancellation of investments from Africa’s FDI partners. Finally, oil-price effects could account for about 15 percent of the losses.

Differing impact on major African economies

While the pandemic’s economic impact—alongside the oil-price shock—will be serious right across the continent, it will be felt differently in different countries. For example, our analysis suggests that the following impacts would occur in Nigeria, South Africa, and Kenya:

- Nigeria. Across all scenarios, Nigeria is facing a likely economic contraction. In the least worst-case scenario (contained outbreak), Nigeria’s GDP growth could decline from 2.5 percent to −3.4 percent in 2020—in other words, a decline of nearly six percentage points. That would represent a reduction in GDP of approximately $20 billion, with more than two-thirds of the direct impact coming from oil-price effects, given Nigeria’s status as a major oil exporter. In scenarios in which the outbreak is not contained, Nigeria’s GDP growth rate could fall to −8.8 percent, representing a reduction in GDP of some $40 billion. The biggest driver of this loss would be a reduction in consumer spending in food and beverages, clothing, and transport.

- South Africa. Across all scenarios, South Africa is facing a likely economic contraction. Under the contained-outbreak scenario, GDP growth could decline from 0.8 percent to −2.1 percent. This would represent a reduction in GDP of some $10 billion, with about 40 percent of that stemming from supply-chain import disruptions, which will impact manufacturing, metals and mining in particular. There will also be major impact on tourism and consumption. However, as South Africa is an oil importer, this impact will be cushioned by lower oil prices. In scenarios in which the outbreak is not contained, South Africa’s GDP growth could fall to −8.3 percent, representing a loss to GDP of some $35 billion. This impact would be driven by disruptions in household and business spending on transport, food and beverages, and entertainment, as well as prolonged pressure on exports. South Africa’s recent sovereign-credit downgrade is likely to exacerbate this outlook.

- Kenya. In two out of four scenarios, Kenya is facing a likely economic contraction. Under the contained-outbreak scenario, GDP growth could decline from 5.2 percent (after accounting for the 2020 locust invasion) to 1.9 percent—representing a reduction in GDP of $3 billion. The biggest impacts in terms of loss to GDP are reductions in household and business spending (about 50 percent), disruption to supply chain for key inputs in machinery and chemicals (about 30 percent), and tourism (about 20 percent). In scenarios in which the outbreak is not contained, Kenya’s GDP growth rate could fall to −5 percent, representing a loss to GDP of $10 billion. As in Nigeria, disruption of consumer spend would be the biggest driver of this loss.

Near-term steps for governments, business, and development institutions

Leaders in the public, private, and development sectors have been quick to act—both to limit the spread of the pandemic and to safeguard economies and livelihoods in Africa. Several African countries have already acted to inject liquidity into their economies, reduce interest rates, help businesses survive the crisis, and support households’ economic welfare—in many cases with the active involvement and support of the private sector.

At the same time, African and international development institutions have announced multi-billion-dollar packages and facilities to alleviate the economic and social impact of the pandemic in Africa and other developing regions. Meanwhile, philanthropic institutions and business leaders have announced major support both for countries’ efforts to contain the pandemic, and for solidarity initiatives to protect households from the economic fallout of the crisis.

Nonetheless, many African countries are still in the early stages of organizing their responses into focused, prioritized efforts that make the most of the limited time and resources available. The private sector and development institutions also have opportunities to target their efforts more effectively and coordinate them more closely with those of government. Citizens also have a key role to play in helping to slow the spread of the disease (“flatten the curve”).

If leaders across sectors translate their already proven resolve into more targeted, collaborative action in the coming weeks, we believe they can make significant progress in mitigating the economic impact of the pandemic—and safeguarding economies and livelihoods. To help them do so, we suggest an organizing framework for action.

An action framework for African governments

The COVID-19 crisis is stretching the capacity of governments across the world, but African governments face greater challenges than most. In particular, they must grapple with the following:

- Limited fiscal capacity. The ratio of public revenues to GDP in African countries averages just 19 percent, compared to 30 percent in Brazil and 37 percent in the United Kingdom—while debt servicing already absorbs 22 percent of revenues in Africa. That gives African governments limited scope for stimulus packages compared to their peers in other regions. Such packages will need to be carefully targeted, and supported by development partners and philanthropic organizations.

- Highly informal economies with many small and micro businesses. Small and medium enterprises create 80 percent of the continent’s employment, compared to 50 percent in the European Union and 60 percent in the United States. African small businesses have limited ability for their staff to work from home, compounded by issues such as power outages and high costs of data. During this crisis, governments will need to extend support to small and medium enterprises, given their role in the economy and the difficulties they face. Additionally, the informal sector is estimated to make up 55 percent of the economy in sub-Saharan Africa, so efforts at economic revitalization will need to extend to informal parts of the economy.

- Young populations, widespread poverty. Africa is the most rapidly urbanizing region in the world, with 50 to 70 percent of urban dwellers living in slums. This has huge implications for the effectiveness and implementation of quarantine methods in these poor sanitary conditions. Africa also has a young population—the median age is 19—and there are an estimated 80 million young people in vulnerable employment and a further 110 million who do not contribute to the economy. School closures will have severe impact on young Africans, with long-term consequences. Female students in particular are at risk: for many of them, a few months’ absence from school could mean the end of their education.

- Constrained health systems. There are 0.25 doctors for every 1,000 people in Africa, compared to 1.6 in Latin America and 3 in member countries of the Organisation for Economic Cooperation and Development. There is also a low number of hospital beds—1.4 beds per 1,000 people versus 2 in Latin America and 4 in China. These factors, combined with limited testing and treatment capability, point to an urgent need to expand healthcare capacity.

Given these constraints, African governments will need to be both targeted and creative in their response to the crisis. They will also need to foster intense and closely aligned collaboration with the private sector and development partners.

We suggest the following as an organizing framework for targeted action by governments. The framework is structured around five priorities (Exhibit 4):

- Set up national nerve centers. Governments, with the close involvement of the private sector and other key stakeholders, need to take rapid action to set up or build out national nerve centers to coordinate and accelerate their response to the crisis. These nerve centers should bring together crucial leadership skills, organizational capabilities, and digital tools—giving leaders the best chance of getting ahead of events rather than reacting to them.2

- Anticipate and manage the health crisis. Governments will need to take even stronger measures to delay and reduce the peak of the epidemic—including more intensive social distancing through mobility restrictions and lockdowns as well as larger-scale surveillance to test and isolate identified cases. In parallel, governments must immediately prepare for a potentially rapid surge of cases, which will demand significant numbers of testing facilities, hospital beds, ventilators and other medical equipment, as well as additional health professionals. Given the limited existing resources in most African healthcare systems, bold and locally tailored measures will be required to create surge capacity and prevent mortality among the most vulnerable population.

- Secure food supply and essential services. Governments need to secure food supply chains, particularly the supply of priority products—and ensure the appropriate pricing of these products. They will also need to ensure that access to essential services such as telecoms and utilities is maintained.

- Ensure support for most vulnerable populations. This includes taking measures to protect jobs and to support affected communities, particularly the most vulnerable populations, through social safety-net mechanisms—including cash transfers.

- Anticipate and manage the impact on the economy. Governments need to anticipate what the impact on their economy is likely to be through scenario analysis and offer a short-term stimulus package to maintain financial stability and help businesses survive the crisis—particularly those in strategic industries. Given the expected loss of tax revenue, governments will also to need to identify opportunities to urgently reduce non-essential spending. Additionally, governments will need to anticipate and prepare for what the post-crisis “next normal” will look like.

While most African countries have already announced specific initiatives across all five areas, they will need to build on these early efforts with great boldness and commitment to collaboration.

Actions for the private sector

The first responsibility of private-sector firms is to ensure business continuity in the ongoing crisis. Based on our discussions with risk and health professionals in more than 200 companies across sectors, we suggest several critical steps for firms—starting with establishing their own central nerve centers. These nerve centers can coordinate company responses on four key dimensions, as follows:

- Protect workforces. The focus here is to guarantee continuation of employment in a safe working environment; adjust to shift or remote work with the required tools; and preserve the employees’ health through safe working facilities and strict isolation of suspected cases.

- Stabilize supply chains. Companies need to guarantee business continuity through transparent supplier engagement, demand assessment, and adjustments of production and operations.

- Engage customers. Companies can hone their crisis communication and identify changes in key policies, ranging from guidelines to guarantee social distancing, to waivers of cancellation and rebooking fees.

- Stress-test financials. Companies need to develop and assess relevant epidemiological and economic impact scenarios to address and plan for working capital requirements. They will also need to identify areas for cost containment across the business.

Beyond their own businesses, private-sector firms also have a critical role to play in supporting governments to tackle the pandemic and its economic fallout. This is especially true of large business and business associations, which will need to work hand-in-hand with governments to manage and mitigate the crisis.

Across the continent, there are many encouraging examples of business stepping up. An example is the Nigerian Private Sector Coalition Against COVID-19, formed by the Central Bank of Nigeria in partnership with private-sector and philanthropic organizations including the Aliko Dangote Foundation and Access Bank. The Coalition is mobilizing private-sector resources to support government’s response to the crisis, and raising public awareness. South Africa’s largest business association, Business Unity South Africa, is coordinating large-scale private-sector involvement in addressing both the health and economic aspects of the crisis.

Individual companies across sectors also have a critical role to play. Examples include beverage producers switching production lines to hand sanitizer; apparel manufacturers producing face masks and hospital robes; telecommunication companies adjusting their data offering; and banks adjusting tariffs. Many companies have also made monetary contributions to solidarity funds for the most vulnerable. More such commitment will be needed.

Actions for development institutions

Development partners have already begun to step up to support African governments in their response to the crisis—including making major financial commitments. As just two examples, the African Development Bank has created a new $3 billion Fight Covid-19 Social Bond to alleviate the economic and social impact of the pandemic; while Jack Ma and the Alibaba Foundations have shipped over 1.5 million laboratory diagnostic test kits and over 100 tons of commodities for infection prevention and control to African countries, via Ethiopia.

Development institutions are also examining their existing initiatives and funding to see how they can best support African countries, businesses, and households. Given the magnitude of the problem, however, they will need to build on these steps with bigger and bolder initiatives. Examples of the actions they could take include the following:

- Repurpose existing 2020–21 funding towards COVID-19 response and recovery efforts. Institutions need to find creative ways to rethink existing funding programs, introducing new flexibility to meet current needs.

- Help governments make smart investments to address the crisis. In repurposing their existing programs, development partners can incentivize and help governments to make smart investments—both to address the immediate needs of the pandemic response, and to shore up the resilience of healthcare and economic systems for the future. For example, they can help ensure that, as governments ramp up surge capacity for COVID-19 lab testing, this has a permanent impact in improving the availability of diagnostics for the population.

- Help governments design effective fiscal and business stimulus packages. Given the unprecedented nature of this crisis, high levels of joint thinking and sophisticated problem solving will be required to design and target effective stimulus packages. Development institutions can provide valuable thought partnership to finance ministries across Africa, as well as much-needed financial support.

- Design new financial instruments to support businesses and countries. These could include solutions spanning liquidity, re-insurance, conditional cash transfers, and more. A critical need will be to develop creative financial-support models for small and informal businesses, as well as for households. This will require real creativity and true partnership between development institutions and commercial financial institutions.

- Support countries to rapidly expand their healthcare systems. Development institutions can help boost access to critical healthcare supplies (such as testing kits and masks); the capacity of the healthcare system (including increasing the number of hospital beds); and the availability of healthcare professionals.

- Help design and launch bold new pan-African or regional initiatives. We set out several ideas for such initiatives—including an Africa Recovery Plan that encompasses an extensive stimulus package—in the final section of this paper.

Bold action needed now

African governments, their partners in the private sector and development institutions are already responding decisively to the COVID-19 crisis. But we believe that most African countries need to expand those efforts considerably, increase the urgency of action, and identify big, bold solutions on both the health and economic fronts. Given the potentially devastating impact of the pandemic on health and livelihoods, nothing less will do.

African governments and development partners could explore several far-reaching solutions, including the following:

- Africa Recovery Plan. This would entail an extensive stimulus package or economic development plan, modelled on the Marshall Plan that provided aid to Europe following World War II.

- Africa Solidarity Fund. Businesses and individuals could contribute to a fund earmarked for immediate relief for the most vulnerable households and businesses.

- Private-sector liquidity fund. This could offer grants, loans, or debt for equity swaps to support businesses and limit job losses.

- African procurement platform. A common platform to procure medical supplies and equipment to combat the pandemic could provide an Africa-wide solution to challenges that each individual country is trying to address.

- Africa Green Program. A get-to-work program that plants billions of trees across the continent, using the currently out-of-work labor force, could provide employment and help solve global and local climate-change issues.

In designing bold solutions, we would encourage African governments and their private-sector and development partners to consider a series of critical questions:

- How big do broad fiscal stimulus packages need to be to have meaningful impact?

- What trade-offs do governments need to make to ensure their countries’ future economic strength while adequately addressing the near-term crisis? For example, these might include making difficult strategic decisions around which companies or sectors to support.

- What conditions can and ought to be imposed on businesses in exchange for financial support? For example, what measures can be taken to ensure that support is used to pay salaries and maintain jobs? Additionally, should entire sectors be restructured and reformed as part of any intervention package?

- How do governments manage the trade-off between protecting the health of vulnerable populations and protecting the economy? When, and how, is the decision on returning to work going to be made?

- What are the best ways to provide targeted support to the most vulnerable populations, rather than offering broad-based support via tax, sector or cash transfer incentives?

- What would be the long-term human-capital implications of these measures, and how could we mitigate those? For example, school closures are necessary now but may negatively impact quality of education and drop-out rates.

We will explore these and other questions in a series of perspectives in the coming weeks.

Note on methodology

The figures and outcomes reported represent a revenue approach to estimating the impact of COVID-19 on GDP growth rates in Africa, for 2020 only. We used African Development Bank (AfDB) projections as the baseline. It is worth noting that our model makes no conclusion about trajectories towards long-term recovery. The model incorporates the following assumptions and methodologies:

- We recognize that there are a vast number of potential outcomes. Scenario-based modelling is provided as a guide across a range of non-exhaustive situations which may materialize. These numbers should not be used as a tool to support budgetary activities for governments or private sector actors.

- The document assumes no economic stimulus from governments. Some African governments have already made commitments which could soften the full economic effect of the virus—for example through fiscal and monetary levers—which will not be reflected here. While we made some assumptions about reduced government spend on business, and reduced government revenues—from oil, in particular—both these elements are changing rapidly. As we continue to update our analysis each week, we will include an assessment of the stimulus gap that exists and indicate how much is being bridged through announced commitments.

- We use AfDB’s GDP growth estimates with 2018 prices fixed to determine real growth impacts and do not account for devaluations, inflationary pressure, or recent credit ratings from Moody’s and similar bodies. These differ significantly by country. Future versions of the model will be more sensitive to these elements.

- We modelled economic impacts for five countries—Angola, Kenya, Morocco, Nigeria, and South Africa—that represent approximately 50 percent of Africa’s GDP. We then extrapolated the impact assessment for the rest of Africa, assuming a lower intensity of impact in other countries as they are less susceptible to some modelling factors such as impact on tourism and oil prices. Additional countries will be modelled in future, and this scaling factor will be adjusted accordingly.

- We translated revenue impacts to GDP through output-to-GDP multipliers that incorporate initial, direct, and indirect impacts to the economy.

- Our modelling approach isolates the potential impact of COVID-19. The inputs that drive the model incorporate both publicly available and proprietary data sources, affording the best available perspective appropriate to the scenario. For example, we adopt different oil price outlooks (ranging from $25 to $35 per bbl) and make granular assumptions regarding changes in household consumption at country level—such as spending on food, utilities, transport, and retail at the product category level. These assumptions are based on input from McKinsey experts across the relevant functions and industries.