The agriculture industry is under pressure. Dramatic cost increases for inputs and labor are putting farmers’ profitability at risk. Globally, farmers report that prices for inputs such as fertilizer and crop protection chemicals have risen by 80 to 250 percent over the past few years.1 Climate change is also squeezing profits. A warmer climate is resulting in increased weather variability, more frequent acute weather events, longer droughts, and new invasive crops and pests, all of which reduce yields. In the American Southwest, for example, an ongoing megadrought is so severe that the past two decades have been the region’s driest in at least 1,200 years.2

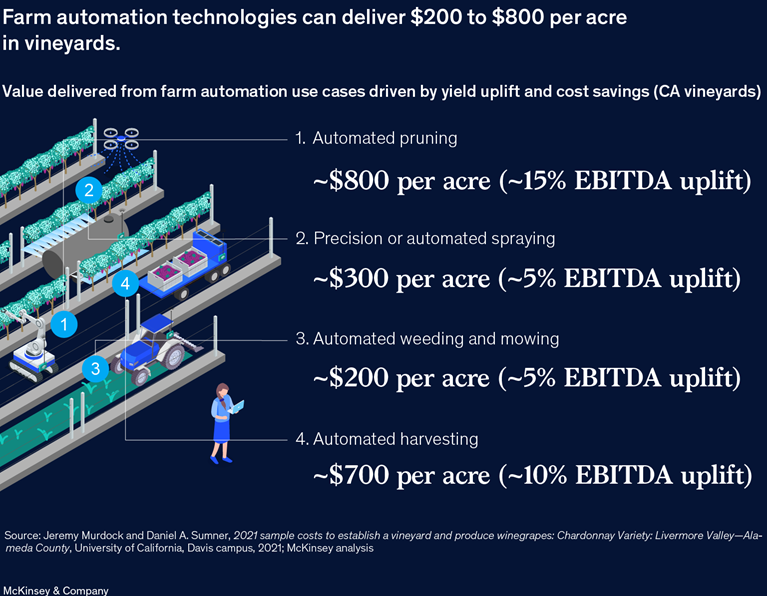

To navigate these challenges and remain economically viable, farmers must find innovative solutions. Automation shows considerable promise for reducing the impact of farming on climate change and helping growers adapt to its financial impact. Autonomous farming solutions exist on a spectrum, requiring varied levels of operator support. This ranges from semi-automated technology widely adopted today (e.g., assisted steering) to fully automated systems (e.g., weeding robots). Next-generation technologies use a combination of sensors, analytics, robotics, and equipment to help farmers make smarter decisions on the field and do more with less. In addition, recent developments in generative AI present future opportunities to automate decision making using vast data sets that already exist. Potential examples include helping farmers develop strategic plans about what inputs (fertilizer, crop protection, and seeds) to apply, at what times and what rates, to best support a farm’s profitability and sustainable practices. Automated technology can deliver significant value to both row- and specialty-crop growers. For instance, fully autonomous use cases across orchards and vineyards can deliver more than $400 per acre per year in value, doubling to quadrupling returns on farmers’ investment in automation.3

These are still early days for autonomy. McKinsey’s 2022 Farmers Global Insights Survey reveals that less than 5 percent of farmers across Asia, Europe, North America, and South America are using this next-generation technology, compared with 21 percent using farm management software.4 We have observed two trends that are likely to boost adoption: pressures on farm economics and the push toward more-sustainable farming practices. In this article, we take a deeper look at these trends and how they are positioned to change the future of farm equipment and farm operations.

Farm economics are an immediate pain point for farmers

Farm automation can help address two problems that have plagued farmers for several years: rising chemical costs and labor challenges.

Input costs

Supply chain disruptions and geopolitical challenges have pushed up the prices of widely used fertilizers (for example, urea, diammonium phosphate, and potash) by more than 15 percent per year over the past five years (Exhibit 1). In a McKinsey survey last year, US farmers ranked input costs as the number-one risk to their profitability, with the price of fertilizers and crop protection chemicals rising the most (Exhibit 2).5

Automation can help reduce these costs by enabling farmers to use pesticides and fertilizers more efficiently. For example, automated precision spraying enabled by sensors and field data (both stored and in real time) can sense gaps between crops and adjust the volume and timing of chemical sprayed accordingly, using fewer chemicals. Some herbicide application technologies use computer vision to selectively spray weeds and avoid crops. On large US corn farms, these solutions have been shown to reduce herbicide costs by 80 percent, creating a value of $30 per acre and a payback period of two years.6 Similarly, fertilizer application robots enabled with sensors can control the amount of fertilizer that is directly applied onto individual seeds during the planting process. This can save more than 93 million gallons of starter fertilizer annually across US corn farms alone.7

Labor challenges

Labor is also a persistent pain point for farmers. Farmworkers are at high risk of injuries and have the highest rate of fatal occupational injuries in the United States.8 Prolonged exposure to chemicals and sun also adds to the perception of farm work as difficult and dangerous.9 In the United Kingdom, for instance, more than 22 million pounds of fruits and vegetables were wasted in 2022 because of a shortage of workers to pick crops.10 Such labor shortages and demands from workers to be compensated for adverse work conditions have accelerated an increase in farmworker wages. In the United States, wages rose 4 percent annually between 2015 and January 2022, compared with less than 1 percent annually between 2000 and 2014 (Exhibit 3).

Automation can help ease these challenges in several ways. It can improve working conditions on the farm, lower the operating skills required by workers, and reduce a farm’s labor costs. For example, semiautomated technology such as assisted steering systems guides tractors to reduce overlap between passes, making equipment operation less physically taxing. Fully autonomous equipment takes this a step further. Instead of sitting in a cab doing hazardous activities such as spraying, machine operators can serve as fleet managers who oversee multiple machines. This also enhances worker productivity and reduces labor costs. In a scenario in which automation enables one worker on a US corn farm to manage four machines, the savings amounts to $15 to $20 per acre, which can unlock up to about $1.5 billion in value annually across all US corn farms.11 For US specialty crops, for which labor is a larger cost driver, the value potential for growers is even greater. For example, in the same scenario in which one worker manages four machines, automated weeding and mowing alone could generate $30 per acre in labor savings on US vineyards. Automation could also help reduce herbicide costs while maintaining yields due to the ability to complete mechanical weeding more frequently given relaxed labor requirements (savings of $100 per acre).

Sustainability is poised to become a future catalyst for change

Unlike input costs, which are an immediate tailwind for adoption, sustainability pressures have yet to be fully realized and are expected to become material in the near future. In a few years, however, action on two fronts—regulators and consumers—could be an even bigger accelerant for automation technologies.

Regulators

Around the world, many governments have set ambitious targets for more environmentally sustainable practices (Exhibit 4). The European Green Deal, for example, calls for a transformation of European agriculture by 2030, including a 50 percent reduction in pesticide use, compared with 2020 levels. Additionally, the plan seeks to transition one-quarter of all agricultural land to organic farming to reduce the use of synthetic fertilizers and herbicides. Similarly, Canada wants farmers to use 30 percent less fertilizer by 2030 than they did in 2020. Canadian growers who don’t meet the target will risk losing access to $1.1 billion in government aid and grants for the purchase of greener farm equipment.12

Automation represents a significant lever for meeting these requirements. By using automated precision-spraying equipment combined with automated weeding or mowing solutions, farmers can dramatically reduce their use of pesticides and fertilizers or potentially eliminate them altogether. Moreover, because automated equipment digitally records what’s been applied to crops, farmers can seamlessly collect data and keep records on their operations. This makes it easier for farmers to participate in current programs such as organic certification and GLOBALG.A.P. Down the road, it could also help farmers comply with the reporting requirements of programs such as the European Green Deal.

Consumers

Consumer interest in a more sustainable food system is growing, with motivated shoppers exerting downstream pressure on farmers to change the way they produce food. A 2023 McKinsey US consumer study found that sustainable brands are already seeing market progress, due to an increased interest among consumers. Products making environmental, social, and governance (ESG)–related claims averaged 28 percent cumulative growth over the past five years, compared with 20 percent for products that do not make such claims. Products making multiple types of ESG claims—such as environmental sustainability and organic-farming methods—grew about twice as fast as products that made only one claim.13

Responding to consumer demand, consumer-packaged-goods (CPG) companies have been actively making a range of environment commitments, including how the raw materials and ingredients that go into their products are sourced and grown (Exhibit 5). Nestlé, for example, has pledged to achieve net-zero emissions by 2050, improve the traceability of its raw materials, and reduce chemical use on farms by 2030.14 Further consumer adoption of sustainability-oriented products is likely to accelerate companies’ ESG journeys.

Software solutions—including farm measurement, reporting, and verification (MRV) platforms as well as farm management systems—are already offering avenues for farmers to begin providing consumers with farm-to-fork traceability. This includes the aggregation and storage of data on planting locations, growing time, and the use of fertilizers and crop protection chemicals. Autonomous equipment with cameras and sensors can take this a step further by collecting and transmitting rich, standardized data with minimal effort from farmers. This can help farmers substantiate the sustainable farming practices that CPG companies increasingly want, including reduced chemical applications, more efficient irrigation, and better harvest conditions.

Excitement for automation is likely to grow

The adoption of automated farm equipment will be influenced by many factors, including technological maturity and performance, macroeconomic conditions, geopolitical dynamics, regulatory decisions, and environmental changes. As they shape their offerings, agriculture companies may want to consider several levers:

- Clearly communicate the ROI and near-term value drivers of autonomous equipment as part of their value proposition, sales pitches, and sales materials.

- Reimagine the farming experience with not only automated equipment but also a suite of software and services that create a digital ecosystem for measuring, tracking, and optimizing everything that happens in a field.

- Evolve business models to reduce the up-front capital costs associated with new automation equipment. For instance, models in which farmers pay regular subscription fees or share a portion of their cost savings with a vendor (such as through price-to-performance) can help make new technology more attractive and affordable for farmers.

- Collaborate more closely with CPG companies to help bring more transparency and traceability to farming, while supporting farmers with the tools and capabilities to make it easy to collect and share data.

If farm economics and sustainability continue to apply pressure on farmers, we anticipate that adoption of automated technology will accelerate dramatically. As more growers realize the triple win that farm automation can represent—greater agricultural productivity and profits, improved farm safety, and advances toward environmental-sustainability goals—excitement about these technologies will spread.