It’s a safe bet that consumers will eventually swap their gas-powered cars and trucks for rechargeable models. Electrified transport, in some form, would seem to be in our future. But how long will investors have to wait for the bet to pay off? Years? Decades?

Bears would bet on decades. For the next ten or so years, the purchase price of an electrified vehicle will probably exceed the price of an average gas-fueled family car by several thousand dollars. The difference is due largely to the cost of designing vehicles that can drive for extended distances on battery power and to the cost of the battery itself. What’s more, the infrastructure for charging the batteries of a large number of electrified vehicles isn’t in place, nor is the industry tooled to produce them on a mass scale. In any case, consumers aren’t exactly clamoring for battery-powered sedans (see sidebar “From well to wheel”).

Bulls are betting on interference by government. They think that concern over energy security, fossil fuel emissions, and long-term industrial competitiveness will prompt governments to seek a partial solution by creating incentives—some combination of subsidies, taxes, and investments—to migrate the market to battery-powered vehicles. In fact, governments across many regions are starting to act in this way. The bulls also note that electrified vehicles can address certain niches whose economics could be favorable more quickly, such as delivery and taxi fleets in large cities or elements of military fleets. In some countries, such as Israel, electrified vehicles already make economic sense because buyers get substantial tax breaks from the government. The bulls include innovators preparing new products and business models (such as the packaging of battery leasing and recharging costs) designed to make electrified vehicles more attractive to buyers.

Sooner or later, electrified vehicles will take off, changing several sectors profoundly. Let’s assume that these vehicles will share the roads of the future with other low-carbon options, such as cars running on biofuels and vehicles with more fuel-efficient internal-combustion engines. Even then, significant sales of electrified vehicles could dramatically reshape the fortunes of the automotive and utilities sectors and propel the rise of a multibillion-dollar battery industry.

The stakes are high for companies in these industries. In the near term, executives should determine how to win revenues and contain costs if the governments of China and the United States, for example, live up to their promises to stimulate consumer purchases of electrified vehicles. Planning should also begin on strategies and on ways to build capabilities if early adoption creates a sustainable market.

Running on electrons

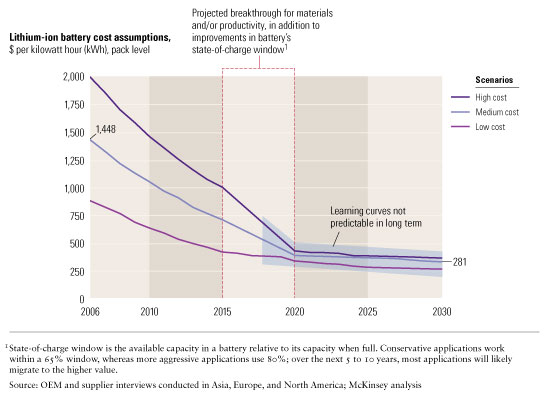

The economics of electrified vehicles start with the batteries, whose cost has been declining by 6 to 8 percent annually. Many analysts predict that it will continue to fall over the next ten years as production volumes rise. Battery packs now cost about $700 to $1,500 per kilowatt hour, but that could drop to as little as $420 per kilowatt hour by 2015 under an aggressive cost reduction scenario. Even then, the upfront purchase price of electrified cars would be quite high. We estimate that by 2015, a plug-in hybrid-electric vehicle with a battery range of 40 miles (before the need for a recharge) would initially cost $11,800 more than a standard car with a gas-fueled internal-combustion engine. A battery-powered electrified vehicle with a range of 100 miles would initially cost $24,100 more (Exhibit 1).

Learning curves

Subsidies could help bridge the difference. China announced that it will cover $8,800 of the cost of each electrified vehicle purchased by more than a dozen of its large-city governments and taxi fleets. Business innovation could address costs too. In the solar-technology market, for instance, SunEdison owns, finances, installs, operates, and maintains solar panels for customers willing to adopt the technology. The company then charges these consumers a predictable rate lower than the one they paid for traditional electric power but higher than the actual cost of generation. That allows the company to recoup its capital outlay and make a profit.1 Innovators are considering similar models to cover the battery’s upfront cost and recoup the subsidy by charging for services.

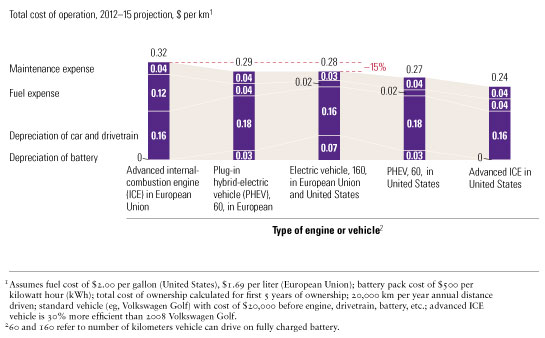

To sway buyers, electrified vehicles—hybrids, plug-in electric hybrids, or all-electric cars (see sidebar “Electrified vehicles: A glossary”)—must be cheaper to operate than gas-fueled ones. The difference between the total lifetime costs of a car with an internal-combustion engine and an electrified car will depend for some time on the difference between the price of gasoline at the pump and the cost of the battery and of recharging it (for those who own the battery) or the cost of leasing a battery and of recharging services. Oil prices have fluctuated wildly over the past two years, and electricity prices vary throughout the world. In Europe, electrified cars (for example, plug-in hybrid-electric vehicles with a 60-kilometer range) could have lower total running costs, assuming an oil price of $60 a barrel and current electric rates.2 In the United States, electrified cars will be less expensive on a total-cost-of-ownership basis only if the price of gasoline exceeds $4 a gallon and electric batteries can go 40 miles before a recharge, or if the government gives manufacturers incentives that subsidize the cost of production (Exhibit 2).

Electric avenue

The proliferation of electrified vehicles will also require an infrastructure, such as recharging stations. China’s State Grid is speeding up plans to build charging facilities in at least three of the country’s largest cities by 2011, and Hawaii has announced plans to build as many as 100,000 charging stations for electrified vehicles by 2012. Investments in capabilities to manufacture the vehicles are needed as well. China, which set a goal of producing half a million electrified cars annually by 2011, has announced that it will invest $1.4 billion in R&D for the purpose. The United States has committed $2 billion in stimulus spending to help companies manufacture batteries and $25 billion for government programs to encourage car makers to retool their production lines to produce larger numbers of more fuel-efficient vehicles, including electrified ones.

Of course, consumers may decline to buy electrified vehicles for any number of reasons: the distance drivers can go before recharging, for example, may undermine acceptance. But on a more fundamental level, electrified vehicles will go mainstream at a pace determined by government action to make gasoline more expensive; to reduce the cost of producing, buying, or operating electrified vehicles; or some combination of these two approaches.

Preparing for tomorrow

There is little point in trying to predict how many electrified vehicles of one kind or other will be on the road by any given year, because so many factors are unpredictable. Governments could aggressively promote the use of electrified vehicles, for example, and then lose tax revenues when drivers spend less money on gasoline at the pump. Will lawmakers in Europe and the United States be willing to sacrifice tax receipts that pay for the upkeep of roads in order to help control climate change. If not, how will the tax burden be migrated to the new fuel: electricity? Besides, electrified vehicles are a nascent technology, and it’s too early to say how the rate of adoption by consumers in different segments will evolve or how costs will be optimized.

But here’s a number to contemplate: electrified vehicles would enter the mainstream if about 10 percent of all cars on the roads were battery-electric or plug-in vehicles, running solely on electric power. That would mean sales of six million to eight million electrified vehicles a year by 2020, which would change whole sectors dramatically. Let’s look at the opportunities and challenges for the three key ones: autos, batteries, and utilities.

Automakers

Electrified vehicles pose an enormous threat to incumbent automakers. The internal-combustion engine and transmission are the core components they have focused on since outsourcing the manufacture of many other components and subassemblies. In a world where vehicles run on electrons rather than hydrocarbons, the automakers will have to reinvent their businesses to survive. Nonetheless, incumbency is also a strategic strength in this sector. Attackers face significant entry barriers, including manufacturing scale, brand equity, channel relationships (for instance, dealership networks), customer management, and capital.

Moreover, electrified vehicles open up opportunities for incumbent automakers. These cars could help them meet increasingly stringent emission regulations and avoid fines. The low-end torque of electric motors can accelerate cars more quickly, smoothly, and quietly, which could provide distinctive new value to buyers. Automakers could also beat attackers to the punch in tapping assets such as plants and dealership networks to introduce new business models, such as selling transport services rather than products. To achieve any of this, auto executives will need to consider the strategic role of electrified vehicles. The plans of the automakers, for example, must include a clear understanding of the way they will prioritize R&D across a portfolio of vehicle platforms, from hybrids to plug-in hybrids to battery-electric models to cars powered by internal-combustion engines.

Automakers should also consider how their relationships with the battery makers will evolve, as well as the role technology standards will play in fitting batteries into vehicles. (Most large automakers are currently partnering with battery companies to develop the electrified or hybrid vehicles they are preparing to launch.) Battery makers and tier-one suppliers will try to secure the value implicit in owning core skills, including innovation in batteries and in the new features they could make possible. Over time, value will probably shift from the battery cell to the electronics and software of the power- and thermal-management system, which determines a car’s actual performance. Executives should develop plans to capture that value when the shift occurs.

Executives should consider the evolution of the downstream business too. Will utilities, gas stations, car companies, or other third parties own the recharging infrastructure and the real estate it occupies, for example? Will processing intelligence and data collection sit in the recharging infrastructure or in the vehicle? Strategists should also think about whether dealers or players like Wal-Mart will sell cars and batteries and about how the supply chain for electrified vehicles differs from the present one. In all likelihood, for instance, demand for lightweight materials will grow, while demand for exhaust systems and mufflers will shrink.

Battery producers

In a world where consumers buy six million to eight million electric-drive vehicles each year, annual sales of batteries might come to $60 billion, and value will start shifting to them from oil.3 Over the long term, the sector’s growth potential is vast, and even the near-term prospects look sunny. For now, battery makers can reap high margins from differentiated battery chemistries that provide a cost, performance, and safety edge. It also helps to win government grants, announced by the European Union and the United States as a stimulus measure to increase domestic battery capacity. The grants have been designed to attract additional private investment.

Nonetheless, battery manufacturers face many challenges. As capacity ramps up, the cells of batteries (their basic element)4 will become a commodity, like many other automotive components. Value will migrate from the cell-level chemistry to the level of battery-pack systems, including power- and thermal-management software, and to the electronics optimizing a battery’s performance in a specific vehicle. To retain value in the longer term, battery makers may want to partner more closely with the automakers’ tier-one suppliers—which aggregate components into vehicle systems, such as steering systems or dashboards—or with the automakers themselves. The latter route would help battery makers preserve more value because they would supplant the tier-one suppliers, but to succeed they would have to obtain the required systems integration skills, knowledge of cars, and key auto relationships. Considering the resources needed to achieve these goals, battery makers would have to ask themselves whether they have the engineering resources to scale the necessary capabilities across a number of vehicle platforms, model derivatives, and OEMs.

Even in the near term, the battery makers can no longer put off some unresolved questions. How, for instance, will these companies protect their intellectual property in process-driven chemistries in order to prevent reverse engineering? One battery maker has spread different parts of its proprietary process across its factories in China, reducing the chance that former employees will reengineer the “secret recipe” for a competitor. So far, patents haven’t been heavily contested, but that could change as volumes and revenues grow. This possibility, as well as the uncertain strength of key patents, means that battery companies must think carefully about how to defend their intellectual-property positions and whether to attack those of rivals. The most important question, however, may be which part of the value chain of batteries will take on the warranty risk associated with them. Car makers don’t want to do so. Emerging battery companies may not have the balance sheets to offer warranties credibly. Incumbents with strong balance sheets and battery businesses—Johnson Controls, NEC, or Samsung, for instance—could provide this service if the opportunity looks ripe.

The evolution of the after-market for batteries is an open question. Since none of them have been tested in large numbers under the real (and diverse) driving conditions they will encounter over their lifetimes, it isn’t clear yet how much residual value there will be. Indeed, batteries at the end of their lives may be liabilities, not assets, because of their recycling costs. (Ninety-seven percent of the lead in lead–acid batteries can be recycled, but lithium is trickier to handle and currently less valuable than lead.) Executives should bake the cost of managing lithium and other component materials into the business model or find ways to ensure that the cost accrues somewhere else in the value chain.

Leading battery makers are already thinking through ways to scale up manufacturing, because they know that there will be first-mover advantages, such as increased automation, increased procurement leverage, and new form factors. These companies are also investing significant sums in R&D for the next generation of battery chemistries. The reason is that the complicated interplay among a battery cell’s core elements (such as the cathode, electrolyte, separator, and anode) determines different aspects of the cell’s performance—for example, power density, energy density, safety, depth of charge, cycle life, and shelf life, which determine the choice of batteries for particular vehicles. Since cell materials account for 30 to 50 percent of the cost of a battery pack, many battery makers are also considering the pros and cons of integrating vertically into key materials.

Finally, battery makers should also think about the possibility of moving into new products or services. These might include offerings for transport sectors (such as maritime, locomotives, trucks, and buses) and for utilities, which might be interested in voltage and frequency regulation, power-management services, and bulk energy storage. Fast charging—applications to deliver lots of power to batteries very quickly, in minutes rather than hours—might be another source of revenues. All of these applications have very different energy and power density needs, as well as different capital requirements and operating expenses. Battery companies will need to place their bets and manage their portfolios carefully.

Utilities and infrastructure providers

Quite apart from electrified vehicles, policies to improve energy efficiency or reduce carbon emissions pose a serious challenge to utilities, whose revenues and profits will come under pressure as businesses, governments, and private homes—stimulated by government investments and by new standards and policies in China, Europe, and the United States—use energy more efficiently. Meanwhile, the utilities’ per-unit generation costs will rise in the near term with the faster adoption of renewable forms of energy, such as solar and wind—intermittent sources that must be supported by a new transmission and distribution infrastructure. Furthermore, any carbon tax or cap-and-trade scheme will affect energy prices and, potentially, the utilities’ long-term profitability.

Electrified vehicles, however, create new revenues for utilities. If 20 percent of the cars and trucks sold in a local market (for example, certain parts of California) over the next decade have electric drives, recharging them could represent up to 2 percent of total electricity demand, according to our analysis of local markets where electrified vehicles might take off first. If vehicles were charged mainly at night, utilities could satisfy much of this demand without installing any significant additional generation capacity.

The charging of electrified vehicles might help utilities profit from carbon-abatement taxes and trading mechanisms as well. These companies, for example, could take steps with their regulators to capture emission credit for the abatement that utilities make possible in the transport sector. In addition, they could reposition themselves in the minds of their customers not only as electricity companies but also as enablers of an environmentally sustainable economy. Any failure to play an active leadership role exposes utilities to the risk of being disintermediated in the residential or commercial segments by other service providers, such as large IT players that already have strong positions in homes (for instance, Cisco and IBM), or by emerging innovators.

Charging at night is the key, however. If utilities don’t install smart systems that control the time when a vehicle can charge, they could struggle to meet peak demand, assuming, as many do, that owners will want to plug in their cars upon returning home in the evening. (Many utilities already struggle to provide enough power in the peak-use early-evening hours.) Worse, electrified-vehicle owners, especially in the early years, will probably cluster together in certain affluent neighborhoods. The incremental demand may be enough to blow out transformers in these areas and require new investments in power generation.

Blowouts would reduce the reliability of the system and the satisfaction of its customers, as well as require expensive investments. Electrified vehicles, we assume, will be twice as popular in certain markets in California than they will be in other parts of the United States. If sales of such vehicles reach 1.8 million in that state by 2020, inadequately managed charging could require upward of $5 billion in incremental investments in transmission and generation infrastructure. This incremental peak-time power will almost certainly come from fossil fuels, which will raise carbon dioxide emissions and force utilities to spend more for emission allowances if they can’t get credit for the increased “well to wheel” efficiency of electrified vehicles.5

To meet the challenge of charging vehicles and of a “smart” charging infrastructure, utilities must start planning now for the necessary technologies, costs, infrastructure partners, and business models. Regulated utilities could try to build the required investment into the rate base by convincing regulators of the business logic. They can also work with automakers to provide a seamless experience for consumers: when someone walks into a dealership to buy a new electrified car, the local utility should know—and be ready to install the right equipment in the customer’s home.

Electrified vehicles will become a reality—sooner, as the bulls believe, or later, as the bears do. That will change the competitive landscape of the automotive, battery, and utilities sectors and have an impact on several others. Companies that act boldly and time their moves appropriately will probably enjoy significant gains; those that don’t will not. But timing is critical: jumping in too early or late will be costly. Buckle up and hang on for the ride.