The halving of crude-oil prices since early March has created an important opportunity for chemical companies, and all buyers of chemicals, to capture savings on oil-based raw materials. The use of new digital tools gives these companies a chance to capture the impact more quickly than they did in previous oil busts. But companies should move quickly, since signs that the economic turmoil resulting from the coronavirus crisis could severely reduce chemical-industry profitability have already appeared. Collectively, the chemical industry is one of its own biggest customers. In the current challenging environment, companies will need to do whatever they can to cut their own costs when they buy, while preserving their margins when they sell. Smart procurement moves and efforts to ensure that the sales force doesn’t lower its sales prices could provide a lifeline to more than a few chemicals players.

The crude-oil price fall could help procurement savings

Crude-oil prices moving at under $30 per barrel during the past two months have been less than half the level of the average oil price during 2019. With the coronavirus crisis’s impact on oil demand and the ongoing market-share war among the world’s leading oil producers, many market observers believe there is a likelihood of crude-oil prices remaining under pressure in the short to medium term.

For the many chemical companies that are seeing deteriorating earnings resulting from COVID-19’s impact on the economy and on the demand for chemicals, the chance to lower their crude-oil-based raw-material purchase costs could offer a lifeline. Raw-material costs are a key driver of profitability across the chemical industry, from upstream petrochemicals makers to the broad universe of specialty-chemical companies that touches areas such as adhesives and sealants, paints and coatings, and soaps, detergents, and personal-care products. In many cases, a downstream chemical company’s raw material will be the end product of a more upstream chemical company. Our analysis shows that a 50 percent drop in crude-oil prices has the potential, if handled right, to generate gains of two to four percentage points in earnings before interest, taxes, depreciation, and amortization (EBITDA) for companies whose raw-material-related spend is equivalent to 10 to 20 percent of their revenues. (Exhibit 1).

Exhibit 2 highlights the effects of oil-price movements on chemical prices. It shows the level of price reductions—in major-volume petrochemicals, polymers, intermediates, and engineering plastics—that followed the 50 percent drop in naphtha prices during the last oil-price collapse, in 2014. We’re starting to see similar price drops now, following the early March 2020 crude-oil price collapse and the hit to demand from the coronavirus crisis.

Chemical companies face some important choices in how to execute their procurement strategies to best help their businesses. In the current challenging market conditions, they should consider taking a careful look at their supply-contract mix and at their approach to pricing, to see if there are savings that can be captured. This examination can include reevaluating the trade-offs between term-contract purchases and buying in the spot market, as well as considering how to optimize the types of pricing arrangements they use for their contract purchases.

If procurement departments expect market conditions to continue to be favorable to buyers, they could consider making more spot purchases rather than committing to contract purchases that are set for many months. Alternatively, buyers may be able to lock in attractive contract and pricing arrangements for the long term from suppliers that, in today’s uncertain market, are looking to secure long-term customers to offtake their production so they can keep their plants operating.

Most chemical companies buy at least part of their raw materials using prices that come from index-based formulas. These formulas automatically, albeit with a time lag of weeks if not months, reflect movements in the price of crude oil.1 In the current market, they may want to see if they can negotiate more favorable terms from their suppliers. For example, many companies routinely secure substantial discounts on formula-based pricing because they are able to renegotiate across different suppliers. In today’s market, they may have the opportunity to secure bigger discounts and lock in more attractive purchase-price conditions, such as getting a pricing formula based on upstream feedstock costs or getting the supplier to agree to a fixed price. Meanwhile, for their non-formula-based purchases, procurement departments must make sure that the fall in oil prices and market supply–demand conditions are reflected at once in the prices they pay.

Our research shows that during the last oil-supply glut, in 2014, there was a substantial difference in the speed and extent to which chemical companies benefited from capturing these raw-material price declines. The companies that came out ahead were the ones that best understood their suppliers’ markets and were ready to take action. We witnessed price differentials of more than 20 percent in what companies were paying for the same type of low-density polyethylene (LDPE) after ethylene and polyethylene spreads widened in 2014 due to the oil-price-driven reduction in ethylene prices. This was because only some of the LDPE buyers had put in place pricing formulas that reflected the ethylene price, while others had formulas that did not. Similar situations occurred in urethanes, acrylates, and other derivatives chains. At the same time, while some companies succeeded in translating the oil-price decline into savings immediately, others benefited only after a six- to 12-month delay, or missed out completely.

New tools can help accelerate the value capture

Chemical-company procurement departments should also recognize that they can now draw on new tools to help them move faster in both identifying and capturing value. Advanced-analytics solutions can assist across a range of areas. For example, using them can help procurement departments quickly identify where they can capture value—in other words, the cost savings. There are a number of new spend-analytics tools that link a company’s spend base to the appropriate market indicators. Other analytics can help speed implementation—using bidding platforms, for instance—and in this way ensure the savings get passed to the company’s bottom line.

Spend analytics

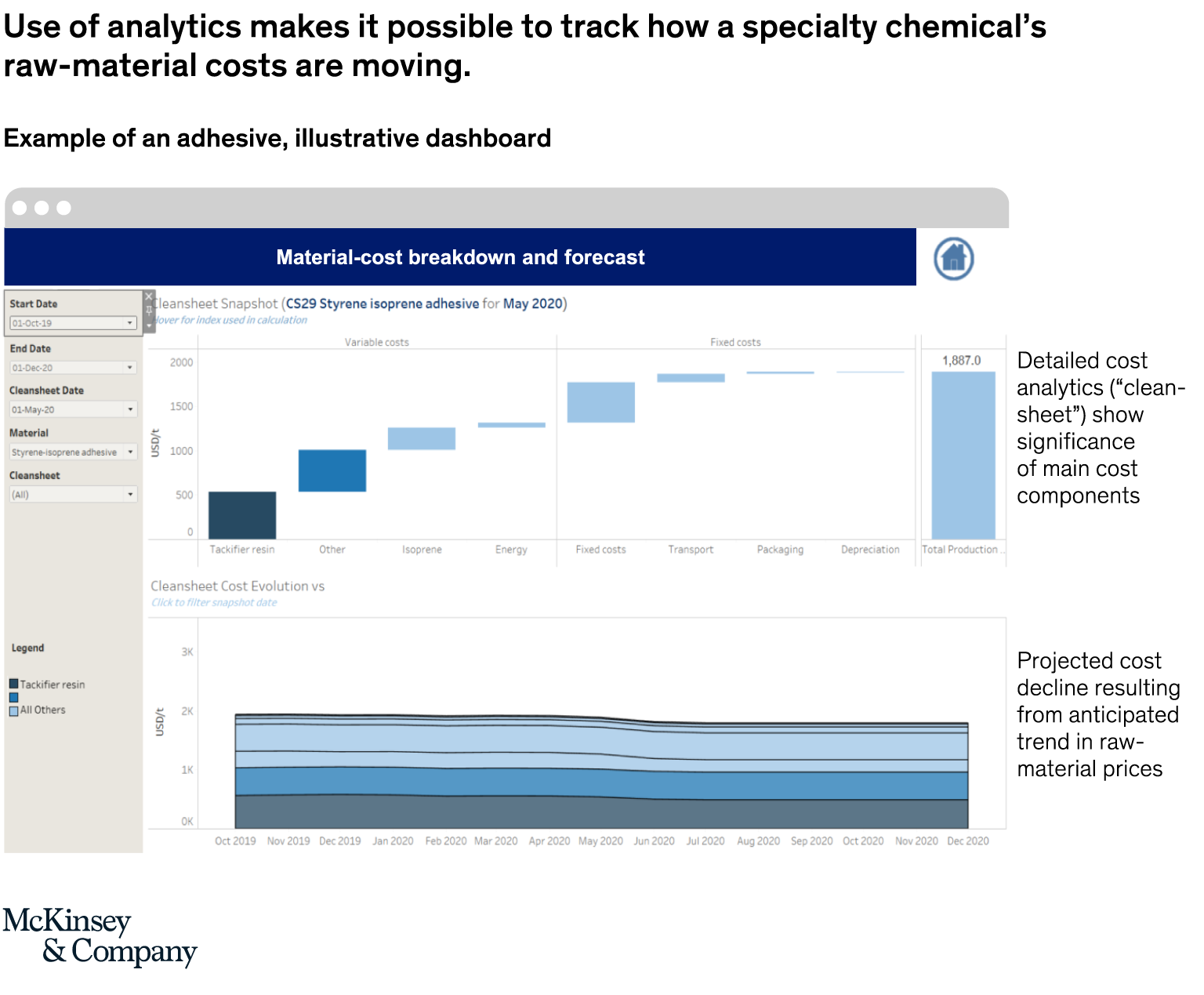

The newest spend-analytics tools make it possible to rapidly link a company’s spend base to appropriate benchmarks such as market indexes, feedstock indexes, or other indicators. For the many materials where market indexes do not exist, cost models can be used to track the evolution of feedstock prices and a supplier’s margin. Each material—from key building blocks and chemical intermediates to specialty chemicals to packaging materials or even to a service such as transportation—can be linked to a combination of the key underlying raw materials and cost drivers (Exhibit 3). Two to three indicators typically explain nearly all of the price movement, and by using analytics, these indicators can be prioritized and given greater attention.

This type of logic can also be applied to product families that share indicators, by organizing them into “archetypes”—for example, different printing inks that use the same types of ingredients or different molded parts made from the same plastic. The same indicator-tracking approach can then be applied across a broader array of purchased products with minimal additional research required.

These tools make it possible to automatically track the impact of upstream raw-material price movements as well as assess the cost-saving opportunity, using heat maps. This in turn can help procurement specialists pinpoint where to focus their efforts to capture the biggest cost reductions. Best-in-class companies will leverage these tools not only to run historical analyses so they can learn how and why prices have evolved but also to forecast how prices are likely to move in the future and thereby identify the initiatives that would generate the greatest savings.

One further area where best-performing companies are putting advanced analytics to work is in designing hedging strategies for their purchases. In periods such as now when prices are showing high volatility, procurement departments can use these kinds of analytics to model possible future price movements, and then plan the appropriate sourcing, timing, and hedging of their purchases.

Procurement departments that take these kinds of proactive approaches instead of relying on pricing formulas can accelerate cost savings by up to six months and provide much-needed help to their companies’ 2020 financial performance. Even if oil prices rebound rapidly during 2020, companies that get moving quickly will still have captured at least part of this savings opportunity.

Advanced sourcing platforms

Once the potential savings have been identified, a systematic approach must be put in place to capture them, and here, too, there are new advances that chemical companies can put to work. The traditional approach of two parties negotiating is likely to still be the most effective for the largest-spend items, such as key raw materials. But when the procurement need is for a multitude—for example in the hundreds—of smaller-volume SKUs spread over many categories, that approach may not be the best fit. Instead, using advanced sourcing platforms that incorporate bidding functionality makes it possible to quickly set up requests for quotations (RFQs) across broad portfolios of products and suppliers. This approach has been shown to help companies invite bids across massive portfolios in a short time and achieve competitive prices. This kind of fragmented spend, where classical tender approaches and negotiations would have been hindered because of the sheer scale of the effort, has now suddenly become possible.

One industrial-coatings player with a tail spend of more than 1,000 distinct purchasing SKUs benefited from tendering at scale to capture savings of €20 million in less than three months, representing a 12 percent reduction in its tail spend. The company accomplished this with a team of just three employees. Now that the oil price has fallen by half since it undertook this initiative, the same team can tender again and—to highlight an added advantage of this approach—reuse 60 percent of the work it undertook last time, in hours spent on tasks such as collecting and entering specifications and required quantities.

How to set about capturing the savings

In addition to digital and analytics tools, the right infrastructure can help companies capture the potential savings resulting from the crude-oil-price collapse. For example, a company could launch a coordinated “war room,” to put it in a position to pursue opportunities worldwide in the short term while also investigating long-term opportunities. The war room typically drives all activities required to capture value, starting by measuring their potential and then setting the pace of execution and keeping track of performance and results.

It is very important for the company’s top management to make sure that the sales force does not simply pass the benefit of procurement savings along to customers. Not only does this practice—which we have observed all too often—undercut the procurement department’s efforts, but it can also further squeeze the company’s profitability. That is because sales representatives will be under pressure from their customer accounts to offer lower prices as soon as oil prices drop, but—as noted earlier—raw-material-indexed price reductions can take weeks or months to move through the company’s inventory. Top management needs to make sure that all these procurement initiatives are complemented by putting in place the appropriate price and margin management on the commercial side.

Here, the war room can play an indispensable role in ensuring that the most significant part of the savings is retained to help boost the company’s profitability. It can also make sure there is close collaboration and alignment among departments, including procurement, supply chain, and sales. In addition, the war-room team will conduct crisis/risk management and assure alignment with other key internal stakeholders—for example, with commercial/sales on demand forecasts and price developments.

Our experience suggests that the most effective configuration for a war-room team is to have a dedicated lead executive, supported by a chemical-market analyst. The lead executive and analyst then collaborate with the product-category procurement managers to help them get better pricing on the commodities their business consumes.