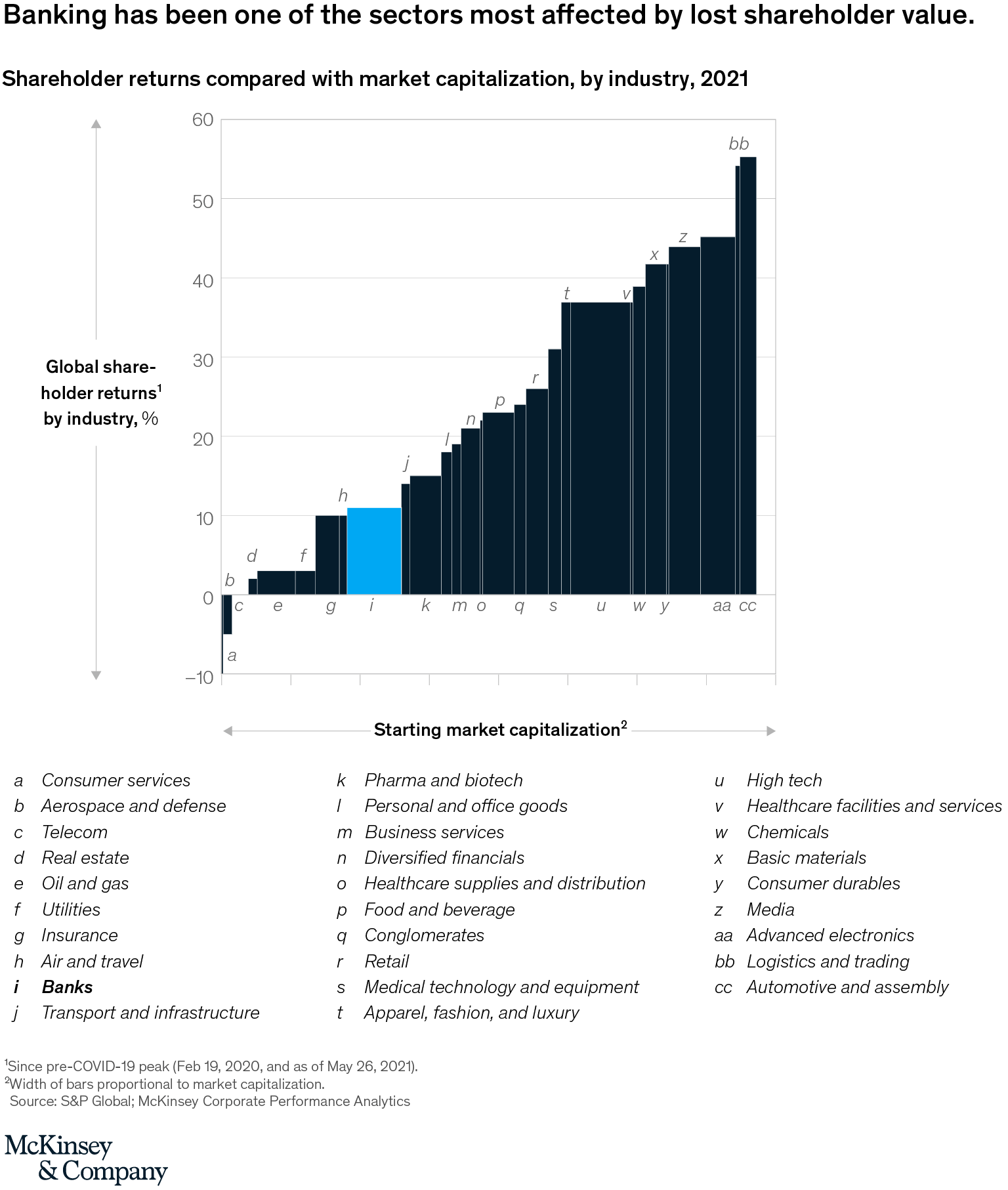

Despite positive signs, the COVID-19 pandemic will have lasting effects, and the “next normal” that will follow it is uncertain. More than a year into the pandemic, the coronavirus continues to threaten people around the world, and economies are changing in unexpected ways. However, vaccination rates are picking up in several countries, bringing relief to many. There is evidence of resilience in the economy as well. Stock markets have shown robust performance so far in 2021, with most sectors exceeding their prepandemic capitalization by double-digit margins as of May (Exhibit 1).

For banks, the pandemic has propelled major shifts in customer and employee expectations. Also, especially in some markets, banks have seen a buildup of loans that may become nonperforming at the end of government moratoriums.1 To keep up with change, overcome the obstacles, and navigate the next normal, banks must adapt, and strategic pursuit of M&A can give them advantages in this effort. But not all mergers are equally effective. In this report, we outline four M&A approaches that banks should consider as they realign to succeed, and we offer practical suggestions on implementation for each approach.

The case for M&A

Even before the emergence of COVID-19, banking was undergoing rapid change. Once the crisis hit, consumer preferences and behaviors accelerated. In a May 2020 survey of more than 8,000 consumers around the world, 20 percent said they expected to rely more on digital banking channels even after the crisis passes. In Western Europe, even customers 65 years and older now prefer to handle everyday transactions digitally.2

Meanwhile, a growing array of nontraditional players, including fintechs, e-retailers, and other big nonbank technology companies, are disrupting incumbents. Private-equity players are stepping up to play an increasing role in the consolidation of the financial-services industry—not only in payments but also in asset-heavy businesses. In addition, private equity will likely continue to disintermediate profitable customer-facing businesses, in many cases without investing vast amounts of capital.

In our May 2020 article, “No going back: New imperatives for European banking,” we shared our perspectives on how banks could rethink their strategies to ensure profitable growth in the wake of the crisis. Ideas included adapting to changing customer preferences and getting fitter to survive in tough times—for instance, by creating a more scalable cost base and doubling down on risk and capital management. We argued that M&A could be a key tool to accelerate these shifts.

Banking M&A activity in the region has indeed continued strong in 2020. The value of announced transactions has declined by 17 percent compared with the previous year, in dramatic contrast to the 70 to 85 percent declines observed in the aftermath of previous economic downturns (Exhibit 2). In fact, the total value of announced deals would have grown if not for the impact of a single large transaction announced in 2019: the London Stock Exchange Group acquiring Refinitiv in the single biggest banking M&A transaction of the previous decade in Europe, the Middle East, and Africa (EMEA). And growth did occur in absolute terms for banks and payments companies—two verticals that typically account for a large share of the banking sector’s total transaction value.

While it is one thing to pursue M&A opportunistically, a critical part of a successful M&A approach is taking a programmatic stance—that is, having an explicit strategy for continual deals, anchored in a “blueprint” that articulates why and where acquirers need M&A to deliver on specific objectives and how they plan to pursue these opportunities.3 Our research into the M&A activity of the largest global companies across industries (the Global 2000) in the decade before the pandemic confirms that those implementing at least two small to midsize deals per year delivered 2.1 percentage points in excess total returns to shareholders compared with the market index (Exhibit 3).4

Banks, however, have yet to embrace programmatic M&A strategies: 65 percent of banking acquisitions were made by acquirers who did fewer than one deal every three years; only 1 percent were made by programmatic players implementing more than two small to midsize deals per year. Taking the lead in this approach therefore presents significant opportunities to gain an advantage.

Programmatic M&A moves for banks

We expect banks’ programmatic M&A strategies to be influenced by four themes that will emerge in the short to medium term and reinforce each other: consolidation, mostly among domestic players, to gain scale advantages; core portfolio optimization through divestment of nondifferentiating assets to solidify balance sheets or scaling up with targeted portfolio investments; new capabilities (for example, through partnerships with fintechs) to maintain or regain innovation momentum; and building ecosystems through acquisitions, alliances, and joint ventures in adjacent markets to broaden the horizon of value-creating opportunities.

While we cite European examples, we believe that these themes are relevant in other regions. Also, regardless of whether banks aim to use M&A to consolidate, optimize portfolios, build capabilities, or expand their ecosystems, we recommend that they look beyond distressed assets and other obvious targets to explore a broader landscape of candidates. Cluster analysis can help would-be acquirers look at a wider range of targets (see sidebar, “How to look beyond obvious targets”).

Consolidation

Given continued top- and bottom-line pressure, banks are likely to seek opportunities to consolidate to capture economies of scale, improve their capital positions, and/or increase investment capacity. We expect many European banks in particular will pursue domestic consolidation for strategic reasons:

- Overlapping in-country physical distribution, headquarters, and support function footprints—spend categories that accounted for 10 to 20 percent of synergies of two recent banking mergers—offer a solid base for short- to medium-term integration synergies.

- Multiple European countries show market fragmentation, signaling consolidation opportunities. In 2019, the European Central Bank reported that the share of assets of the top five credit institutions in the EU varied between 29 and 97 percent, with a median of roughly 65 percent. To facilitate sustainable consolidation, the ECB adopted new supervisory guidelines in January 2021 that, for instance, do not “penalize credible integration plans by setting higher Pillar 2 capital requirements.”5

- Managing a domestic integration, while challenging, is less complex than managing a cross-border deal of similar scale—particularly if the banks are also making other transformative moves, such as developing innovative customer value propositions, transforming a branch network, or creating a structurally leaner cost base.

Another factor likely to fuel domestic consolidation is the fact that even before the economic downturn, banking sectors in these markets reported relatively low returns on equity, indicating an urgent need to improve financial performance, and a relatively high level of fragmentation (Exhibit 4).

Over the past decade, cross-border consolidation has not been a major feature of European banks’ M&A activities. In recent years, however, some international banks have increased their group-level integration by centralizing payments, support functions, and IT platforms across borders. While these moves may not technically be M&A transactions, they do fit into the merger-management playbook, as they are aimed at creating synergies through scale.

Based on our experience in financial services around the world and the character of the current economic downturn, we see six keys to success in consolidation-driven banking M&A:

- Have a clear strategic rationale. “Because the price is right” is not—on its own—a reason for acquisition. A deal must have a clear strategic objective. This principle is even more important in the context of uncertainty about the full structural impacts of the COVID-19 pandemic.

- Use integration to transform the bank. M&A-driven discontinuities can be opportunities to transform businesses, adapt to shifts in consumer behavior, and capture efficiencies. In the case of the postintegration branch network, for example, a bank can go beyond typical footprint optimization and rebranding to rethink the role of the branch itself, particularly as customers become more accustomed to remote interaction.

- Make clear and early decisions on integration architecture and scope. Banks should be unambiguous about which areas will shape the operating model of the combined entity, including branch-network design, IT landscape, and the approach to migration. This effort helps minimize missteps that can cause unexpected delays and significantly raise integration costs. The most effective buyers focus on key issues and set up an experienced integration team.

- Use forward-looking performance indicators to safeguard business continuity and momentum. Our research suggests that companies consistently underperform their revenue synergy target in M&A situations, capturing on average only about 77 percent of the original revenue synergy target, and that revenue synergies take longer to capture than cost synergies. Target-company sales performance tends to slow down—in some cases declining by 10 percent—in the quarter after the announcement.6 To ensure full synergy capture and to protect and track business momentum, banks can use high-frequency forward-looking key performance indicators (KPIs), such as deposit volumes and numbers of transactions or complaints. On the corporate side, they can track loan renewals and credit-line drawdowns, for example. They should also focus relentlessly on customer service and complaints during the integration process to maintain business momentum; keeping a good customer is much less expensive that finding a new one.

- Plan for IT and cybersecurity. We expect that more data will be accessed outside of bank premises, given that remote working arrangements spiked in response to the pandemic and seem likely to remain above pre-COVID levels. Access to data from more locations makes institutions more vulnerable to cyberattacks. Strict protocols must be in place to protect critical data, especially during systems migration.

- Manage the integration quickly and seamlessly, involving senior leaders. Across industries, poorly managed integrations create confusion and disruption, driving top talent and good customers into the arms of competitors. To limit these risks and maximize the value of a deal, senior leaders must drive integration, transformation, and communication simultaneously and without delay.

Corporate portfolio optimization

As detailed in McKinsey’s Global Banking Annual Review at the end of 2020, banks need to reinvent and optimize their business models to sustain them through a “long winter” of near-zero interest rates and economic disruption. Options will include streamlining—exiting nondifferentiating activities, subscale business lines, and noncore geographies—and scaling up in a business line or geography where size is increasingly important.

Exiting nondifferentiating activities can reduce a bank’s operating expenses, ease overall business complexity, free up management time, and free up capital. Multiple banks have gone through portfolio optimizations and divested multiple subscale businesses or geographies. Our research suggests that divestments make up around 40 percent of deal numbers and tend to be more common following a crisis; they were in the range of 40 to 50 percent during the dot-com crash in the early 2000s and the subprime-mortgage and sovereign-debt crisis of 2008–11.7

One of the movements we have observed is for banks to divest nondifferentiating activities in the form of industry utilities. The most frequent divestments of this type involve payments processing, risk management and compliance (including know-your-customer), ATM and cash management, and lending services. One example is Geldmaat, a shared ATM and cash-handling utility in the Netherlands.

The other side of the coin is to invest systematically in industry verticals, such as payments, wealth management, consumer finance, leasing, or factoring to build scale and scope over time. Examples are BNP Paribas’s scale-up in leasing solutions, Santander’s growth in the consumer-finance space, and ABN Amro’s strategic partnership with investment-banking firm ODDO BHF on equity brokerage. As banks consider optimizing their positions in these verticals, product and market acquisitions or cooperation with vertical specialists may become attractive propositions.

Capability plays, including alliances with fintechs

As in other industries where innovation is accelerating and talent is scarce, banks are seeking new capabilities and new talent to become more competitive in preparation for the recovery of the economy. Alliances—or even acquisitions—of fintechs are one way we expect banks to address these needs.

After years of rising investment, COVID-19 caused only a temporary slowdown. In 2020, funds flowing into the global fintech sector dropped by 7 percent compared with the previous year. In the first three months of 2021, global deal volume recovered strongly, registering nearly three times larger aggregate volume than in the same period in 2020.8

Partnering with or acquiring fintechs with complementary or adjacent value propositions and embedding such value propositions in the acquirer’s core business has already begun. Examples include Santander’s recent investment into Ebury, an FX payments provider, and ING’s acquisition of Lendico, an online credit marketplace in 2018. These arrangements can yield lasting and substantial benefits—assuming the acquirers get certain things right.

As noted earlier, the best acquisition teams in banks carefully set the strategic rationale for every acquisition, looking well beyond price. Particularly in fintech deals, they set a narrow scope for the integration—for example, requiring only a minimum of shared values and strategic controls, allowing the target great operational freedom, and providing a plan for talent retention up front. Many fintech designers, coders, and entrepreneurs, especially those involved in business-to-consumer businesses, are very different from banking managers. Keeping them happy, productive, and onboard is a key to a successful acquisition.

Building an ecosystem through partnerships and acquisitions

As we’ve noted elsewhere, customer behaviors and expectations regarding digital banking have accelerated during the COVID-19 pandemic. This strengthens the case for incumbent banks to join or establish ecosystems.

Effective ecosystems offer interconnected, cross-sector services, broadening the value proposition and relevance of each company involved. A Middle Eastern bank, for example, established a stand-alone digital platform to provide farmers with financial and administrative services and agricultural advice. A European bank created an ecosystem that provides customers with offerings from more than 30 brands, including cybersecurity and e-health.

Banks are more likely to create a successful ecosystem when they start with a clear vision of the target state and how it will create value and when they make careful, individual decisions about whether to build, partner, or buy each ecosystem element. In addition, banks pursuing partner or buy strategies need more dynamic and larger-scale integration and partnership capabilities than those integrating with other financial-services players, given the range of industries and sizes of the targets or partners.

Banks that succeed in partnering with or acquiring other companies to form ecosystems manage a few elements exceptionally well:

- Talent management. They find and retain talent, especially the “business builders” critical to scale up ecosystem companies. This often requires accepting the acquired company’s culture and ways of working, so as to prevent rapid employee churn.

- Growth strategy. They collaborate for growth, not returns on equity, and design performance metrics accordingly, since the best ecosystems engage a broader set of potential customers.

- Performance management. They create a home for ecosystems in the bank, providing ecosystem companies with dedicated senior-management attention. This attention is anchored in the ecosystem strategy, which is translated into KPIs that cover, for instance, customer acquisition, customer experience, and cross-sales, over and above typical measures of investment performance, such as net present value.

Given the dramatic changes in the economy and the industry, business as usual is a losing strategy in banking. Slow-moving incumbents will eventually become acquisition targets for their nimbler, more imaginative competitors—or simply disappear. Now is the time for banks to rethink strategy. Thoughtful M&A approaches aiming to consolidate, optimize portfolios, build capabilities, or expand ecosystems can open up new avenues for growth in whatever environment becomes our new normal.