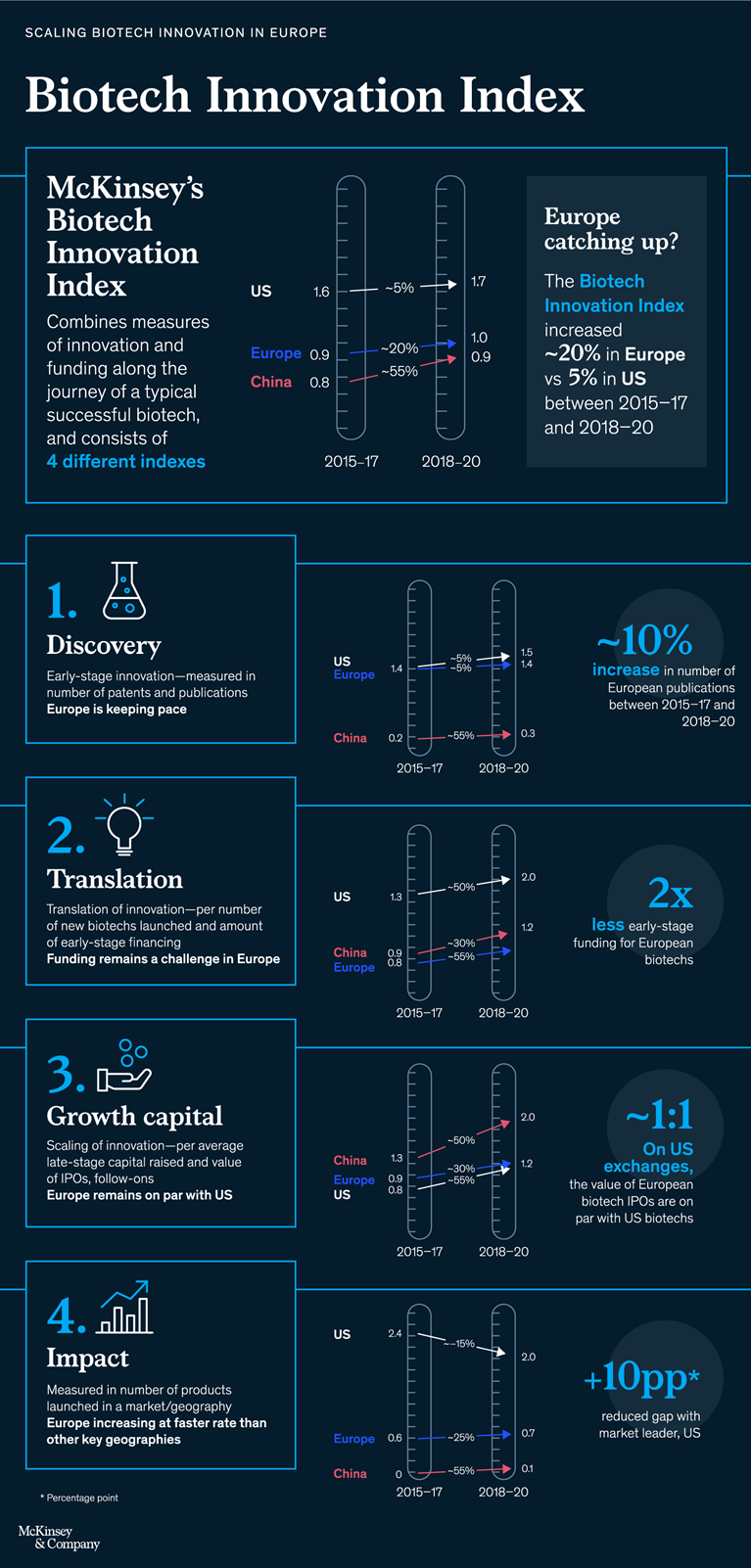

McKinsey’s Biotech Innovation Index assesses innovation and funding in terms of four indicators: discovery (measured in numbers of patents and publications); translation (measured in numbers of new biotech companies and average amounts raised in early-stage financing); growth capital (measured in average amounts raised during late-stage funding and by IPOs and follow-on offerings on public markets); and impact (measured in numbers of products launched).

Europe’s overall score on the index improved by 20 percent in 2015–17 and 2018–20, compared with an improvement of 5 percent in the United States, although the US score of 1.7 is considerably higher than Europe’s score of 1.0. China has almost caught up with Europe with a score of 0.9, an improvement of 55 percent above its previous score.

In looking at the individual indices, the “Impact index” shows the most progress, as Europe’s rate of product launches is increasing at a faster rate than other key geographies and making progress in closing the gap with market leader the United States, in particular.

Europe is roughly on par with the United States in early-stage innovation, as measured by the “Discovery index” (1.4 versus 1.5 for the United States and 0.3 for China). More than 40,000 biotech patents have been granted in Europe since 2015, although the region’s 3 percent CAGR in patent approvals in 2015–19 lagged behind that of the United States (4 percent) and was a fraction of China’s (14 percent).

Growth capital shows signs of maturing, as European biotechs are catching up with their counterparts in the United States and China in average late-stage venture funding. However, raising large capital sums in IPOs on European stock markets has continued to be difficult; the mean size of European biotech IPOs was four to five times larger on US exchanges than on European exchanges.

Europe also continues to have a lower score than the United States and China in the “Translation index” (0.8 versus 2.0 and 1.1, respectively) and is not growing fast enough to close the gap (25 percent CAGR) into this new decade. This reflects Europe’s continued challenge in transforming its research-powerhouse status into a pipeline of new medicines. Continual focus and more urgency in action to drive translation from the various stakeholders is key.

Read more in our article “Can European biotechs achieve greater scale in a fragmented landscape?” and download our full report.