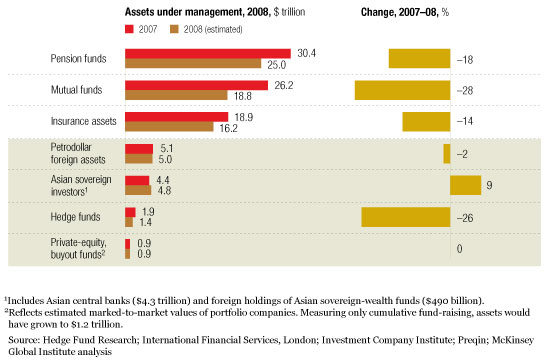

Last year’s events have altered the fortunes of the four large groups of investors—oil exporters, Asian sovereign investors, hedge funds, and private-equity firms—described as “the new power brokers” in a 2007 report from the McKinsey Global Institute.1 That MGI study analyzed their rapid rise in wealth and clout at a time of soaring crude prices, expanding trade, and cheap credit. Although the boom years ended in late 2008 as the financial crisis escalated and the global economy slumped, new MGI research shows that the power brokers fared relatively well.2 But their future paths have diverged: petrodollar and Asian sovereign investors are more influential than ever, while the rapid growth of hedge funds and private-equity firms has halted abruptly.

To understand the future evolution of the power brokers, we modeled changes in their financial assets over the next five years under different macroeconomic scenarios, each with a specific trajectory for global GDP, oil prices, trade, recovery in financial markets, and other key variables. We find that the assets of oil exporters and Asian governments will grow rapidly in nearly any scenario. The source of their wealth—trade surpluses—will continue in every case we considered, though the magnitude of those surpluses would vary. Indeed, we now project that in the base-case scenario the financial assets of oil exporters and Asian governments will reach levels higher than those we projected in our original 2007 report. In contrast, our future projections for assets under management by hedge funds and private-equity buyout funds are lower. We still expect the best of each to survive and even thrive, but it will take time for the portfolios of these institutional investors to recover sufficiently for them to raise substantial new funds.

Holding steady

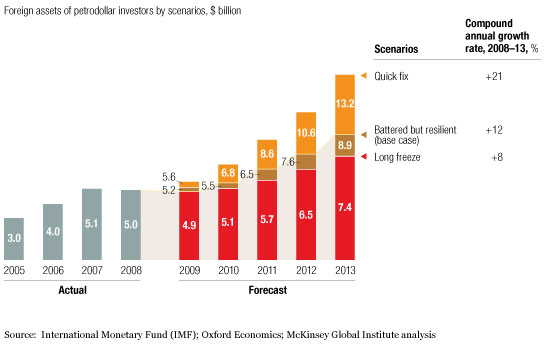

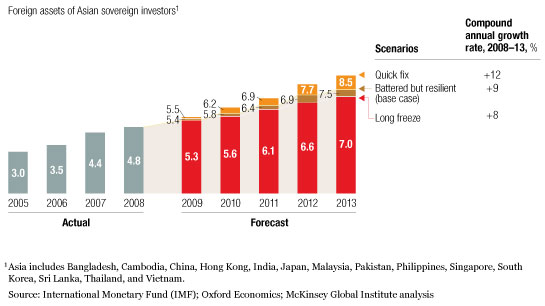

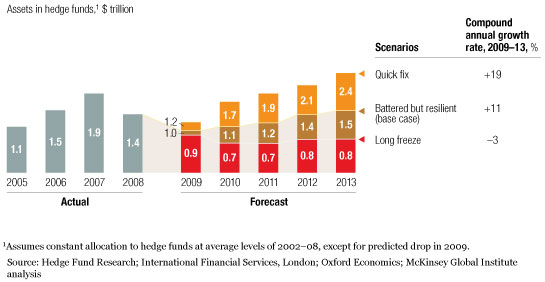

Here we will outline our projections for the four groups of investors under three of the four scenarios we considered. The first scenario, the “quick fix,” envisions a relatively fast economic recovery in which global GDP starts growing again in late 2009, oil prices climb steadily to nearly $100 a barrel by 2013, Asian trade surpluses grow (though more slowly than in the past), and credit markets return to health. In our base-case scenario, “battered but resilient,” the global economy starts to expand only in mid-2010, crude oil surpasses $70 a barrel by 2013, and trade and credit markets recover more slowly than they do in scenario one. The worst-case scenario, the “long freeze,” involves a very severe economic downturn: GDP doesn’t start growing again until 2011, oil lingers at $50 a barrel for years, world trade remains well below its peak, the wealth of global investors is slow to recover, and credit markets remain constrained.3

Petrodollar investors—including central banks, sovereign-wealth funds, high-net-worth individuals, and other investors from the major oil-exporting countries—would remain the largest of the four classes of power brokers over the next five years under all of our scenarios. In the base case, we project that the foreign financial assets of these investors will rise to nearly $9 trillion by 2013. In the quick fix, with a faster economic recovery driving the price of oil to nearly $100 a barrel, their assets grow to more than $13 trillion, nearly half as large as the assets of the world’s pension funds in that year.

Bright prospects

The sovereign investors of Asia—its central banks and sovereign-wealth funds—see their foreign wealth grow to $7.5 trillion by 2013 in our base case. China, with its foreign financial assets growing to $4 trillion, accounts for more than half of this total, though its current-account surplus declines relative to GDP. In the quick fix, with world GDP and trade recovering more quickly, the foreign assets of Asian sovereign investors grow to $8.5 trillion.

Significant growth

In 2009, the hedge funds’ assets under management decline further in all scenarios, reflecting continuing net withdrawals by investors during the year’s first half. In our base case, assets recover slowly thereafter, to $1.5 trillion by 2013. That’s slightly better than the total at the end of 2008 but still well below the peak in 2007. A major constraint on the growth of hedge funds is the size of their investors’ portfolios: the collective wealth of pension funds, insurance companies, endowments, sovereign-wealth funds, high-net-worth individuals, and other such investors fell from $91 trillion in 2007 to an estimated $75 trillion by the end of 2008. In our conservative base-case scenario, battered but resilient, in which the economic recovery doesn’t begin until mid-2010, it takes four to five years for these investors’ assets to regain their 2007 levels. Unless the appetite for investments in hedge funds increases a good deal, this delay will substantially curtail their fund-raising.

Falling from the peak

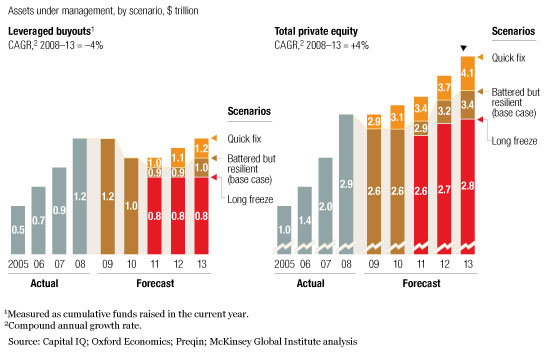

As for private-equity buyout funds, their assets under management fall in our base case, to $1 trillion by 2013. For starters, the collective wealth of their investors (like those of hedge funds) has declined sharply. Second, this scenario assumes that megadeals—leveraged buyouts worth more than $3 billion apiece, which dominated private equity during the boom—won’t revive anytime soon, because investors have less appetite for them, and banks working through credit losses face funding constraints. Meanwhile, private-equity managers are looking beyond buyouts, to other types of investments, such as distressed debt, infrastructure, real estate, and venture capital. We therefore project that total private-equity assets under management will grow modestly in our base case, to $3.4 trillion in 2013.

Private-equity split

No one knows how the current financial and economic turmoil will play out, but our analysis shows that in virtually any scenario, the power brokers will remain a significant force in global capital markets. Oil exporters and Asian sovereign investors will continue to be major players, controlling vast pools of wealth. Hedge funds and private-equity buyout funds are down but not out.

This article is based on the McKinsey Global Institute report The new power brokers: How oil, Asia, hedge funds, and private equity are faring in the financial crisis.