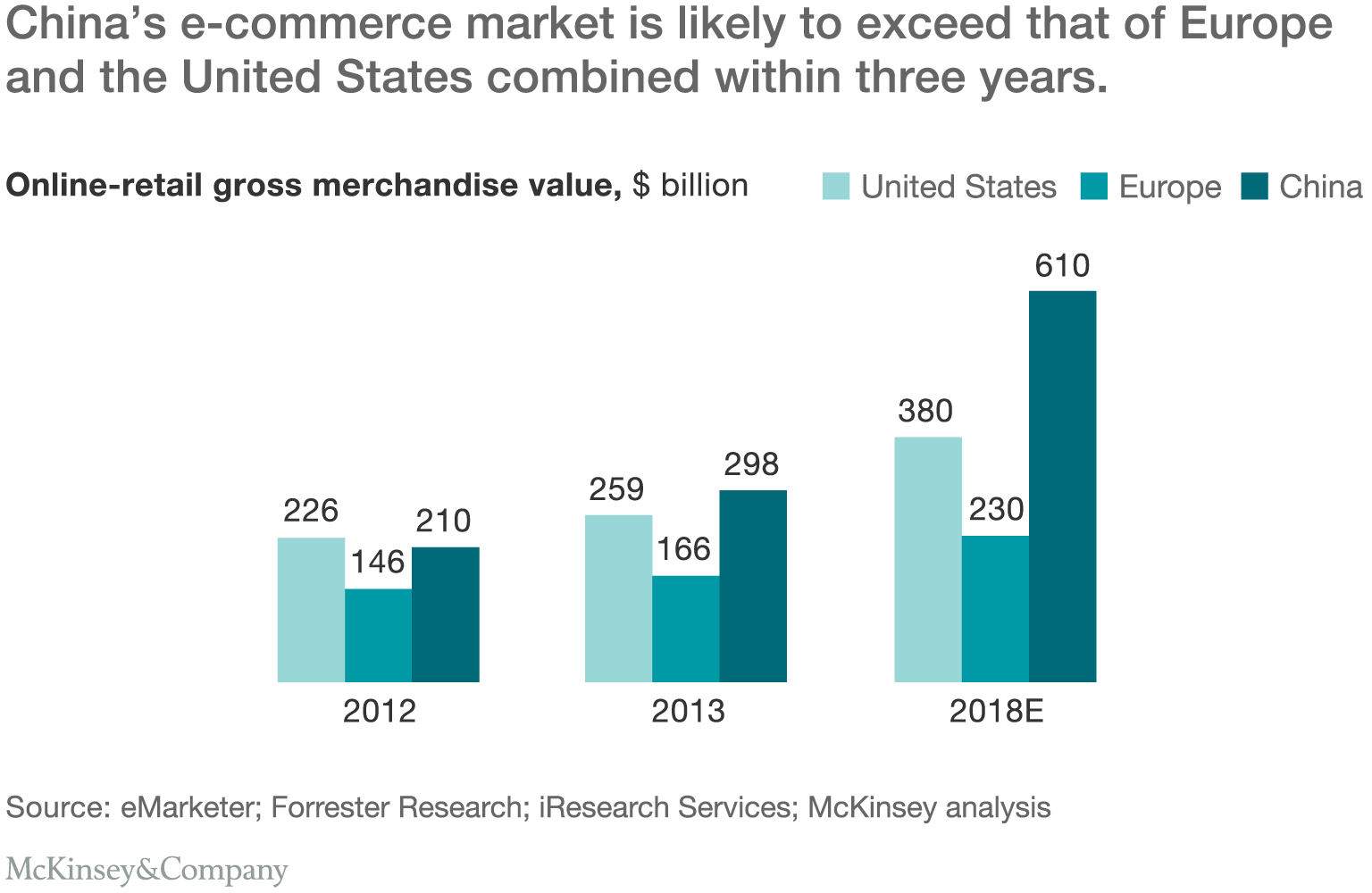

China’s annual online-retail sales passed those of the United States in 2013. By 2018, they are estimated to reach about $610 billion—passing Europe and the United States combined (exhibit). Yet though the market is vast, succeeding in China is far from easy. While select leading Western companies have captured some of the country’s explosive e-commerce growth, many make basic mistakes, from equating China’s e-commerce leaders with US companies (“Alibaba is China’s Amazon!”) to assuming selling and distribution practices from home markets are transferable. The reality is that China is simply different. As a point of comparison for consumer and retail companies, we regard the combination of the size of the prize and the degree of change needed to succeed as roughly analogous to what consumer-packaged-goods companies experienced in the late 1980s when Walmart changed the consumer game.

Understanding China’s e-commerce market starts with knowing its online consumers and companies. First, there are more than a dozen multibillion-dollar players shaping parts of China’s digital marketplaces, ranging from JD.com (a cross-category e-tailer) to VIP.com (a fashion-focused discount e-tailer). Engaging with just one of these important platforms isn’t enough—they are interrelated, and you need to work with several. Second, no strategy can ignore the country’s three digital powerhouses: Baidu, the largest search engine; Alibaba, proprietor of the largest online shopping mall; and Tencent, the leader in gaming and social networking (see sidebar, “Understanding BAT”). While each may appear as though it plays in a different arena (search, e-commerce, and social, respectively), in reality, the companies compete more directly with one another. Through organic and acquisitive growth, each has a role throughout the online consumer’s decision journey: generating demand, finding and comparing local merchants, moving customers from consideration to making a purchase, paying, and then reviewing or telling a friend and building loyalty.

Five keys to digital commerce in China

Perhaps it’s no wonder that creating a complete digital-commerce strategy in China can seem excessively complex when viewed through the lens of practices in other economies. Yet the effort is worth it. Each of China’s digital players is a crucial partner, capable of connecting brands with hundreds of millions of new customers. In our experience, mastering the country’s e-commerce landscape is a journey specific to an industry and a company. We recommend strategies that incorporate the following five priorities.

Adopt an integrated platform strategy

Retailers know that e-commerce platforms can compensate for limited physical-store networks. This is especially applicable in China, where our research shows consistently that up to 70 percent of Internet users shop online regardless of the size the cities in which they live, despite significant differences in Internet penetration (which averages 86 percent in Tier 1 cities, compared with 52 percent in Tier 3 cities).1

Yet advanced consumer companies in China don’t just sell online through their own sites. They use a variety of digital platforms, typically managing a flagship store on Tmall and selling through cross-category players such as JD.com and category-specific sites such as VIP.com. It’s an approach international players have evolved to adopt. Even British luxury brand Burberry now has a flagship digital store on Tmall, giving it access to traffic beyond its usual customers by virtue of being on the broader platform.

Understand China’s vast network of distributors

Managing distributors in the digital space in China is different than in the West. The country’s e-commerce market is filled with small distributors who have opened online shops through Tmall or Taobao, Alibaba’s consumer-to-consumer platform embraced by millions of small businesses and entrepreneurs.

While consumer to consumer is declining as a percentage of China’s total e-commerce market, it still accounts for about 50 percent of China’s e-commerce sales. That makes it a critical platform for companies, even if sites such as Taobao present challenges for global brands. That’s because brands have little control over how products are presented or priced: anyone with a Chinese identification number can set up shop on Taobao, and the site has become a haven for counterfeiters, as well as for parallel importers—who purchase genuine foreign products meant for sale in other countries but bring them back to China for resale (often without paying import duties). In addition, excess inventory from large retailers or their sales forces also serves as a major source of authentic products on Taobao, sold at significant discounts.

While Alibaba has strengthened measures to purge pirates from Taobao, we’ve also seen multinational corporations evolve their approaches. At first, many battled rogue distributors with a variety of “get tough” measures, ranging from lodging official trade complaints to using computer chips and bar codes to track down inventory leaks. Yet practices involving “carrots” as well as “sticks” are more effective. Several large consumer companies, including Kimberly-Clark, have instead proactively identified and partnered with their largest local distributors on Taobao, providing them with store certificates, stable product supply, and select product prelaunch benefits. In return, Kimberly-Clark asked distributors to comply with its branding and pricing guidelines, for example.

Would you like to learn more about our Retail Practice?

Harness the power of social media

Brands have found social media especially important in China. Chinese consumers do not trust official sources, such as government and big corporations, and as a result, their purchasing decisions are influenced much more by word of mouth. In fact, two-thirds of China’s consumers cite recommendations from families and friends as the critical factor influencing their decision to buy, compared with only one-third of consumers in the United States. What’s more, we regard China’s social-media-platform leaders as more attuned to commerce and opportunities to work with brands and retailers than their US counterparts—none more so than China’s dominant social-media player, Tencent, which evolved its WeChat messaging service from a platform for social networking to one for customer relationship management, commerce, and payments.

Xiaomi, for example, used WeChat to manage both product-launch buzz and sales. And since Hanting Hotel, a local midprice hotel chain, began providing virtual membership cards through WeChat, it has recruited more than 500,000 members and realized 62,000 room bookings. In parallel, WeChat is rapidly evolving its commerce services. Our recent iConsumer survey found that 15 percent of WeChat users have made a purchase through the WeChat platform, and 40 percent are interested in doing so in the near future. Many brands are adding WeChat commerce functionality into their official WeChat accounts.

Leverage China’s growth in location-based services

China already has more mobile Internet users than PC Internet users. Our research shows that almost two-thirds of Chinese consumers have made mobile purchases, and mobile commerce is predicted to surpass PC commerce in 2016. Not surprisingly, as mobile grows exponentially, so will location-based services that make online-to-offline transactions ever more important.

China is rapidly becoming a market where the consumer shopping experience integrates social media, location-specific information, and mobile-payment capabilities on smartphones. For example, mass chain player Pudding Hotels uses WeChat’s “people around me” function to proactively recommend its hotels to users based on their location—a service that generated more than 10,000 WeChat-enabled bookings within three months of launch.

We are finding that winning brand-building and e-commerce strategies increasingly require leading-edge capabilities to partner with digital platforms in social media, location services, and mobile marketing (“SoLoMo”) and, ideally, mobile commerce and payments.

Work with platforms to understand China’s consumers

Need to know more about your potential customers? Brand owners and retailers can uncover consumer insights by collaborating with digital-platform businesses in China. Consider P&G, China’s biggest digital advertiser, which has partnered with Baidu to develop multichannel advertising campaigns for its products. In reviewing search patterns for P&G’s Olay skin-care products, for example, Baidu analysts determined that many users were framing their queries in ways that suggested a strong connection between concerns about skin care and aging. P&G used those insights to devise an advertising campaign built on the idea that Olay products could help older women “hold on to age 25,” a message that resonated strongly with Chinese consumers. Similarly, a diaper player worked with business-to-consumer e-commerce player Dangdang to identify pregnant women entering their third trimester and issue relevant coupons.

Working with China’s e-commerce providers to codevelop consumer insights can benefit brand owners, retailers, and platform companies—and help strengthen a company’s relationship with China’s e-commerce players beyond being purely transactional.

Global brands will not maximize their digital-commerce potential in China solely with practices and formulas that have worked for them at home. In fact, success may require unlearning what you know to understand how to operate across China’s multiplatform e-commerce environment. Finally, the country’s landscape is still evolving quickly. Aside from the principles above, being alert to new channels and new business models and being ready to adapt early is also essential to future success.