US consumers have responded to the global economic crisis by curtailing their expenditures, paying down debt, and saving more—all logical responses to a recession. Yet most consumers have acted by choice, not necessity. Spending, saving, and debt averages are not at abnormal levels today but rather returning to long-term trends. It was the behavior of US consumers during the past two decades, our research shows, that was the aberration. The return to traditional spending patterns will cause companies to adjust to a fundamentally altered playing field.

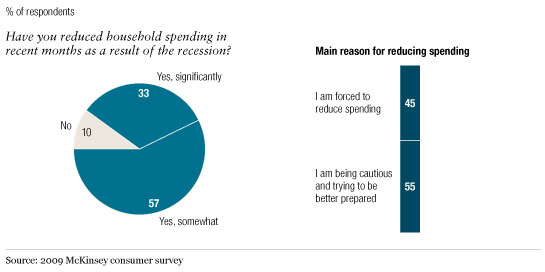

In a McKinsey survey conducted in March 2009, 90 percent of the US respondents said that their households had reduced spending as a result of the recession—33 percent of them “significantly” so. The survey, which included 600 households in three consumer segments comprising around 40 percent of all US homes,1 found that 45 percent of those who reduced spending did so by necessity, 55 percent by choice (Exhibit 1).

Tightening belts

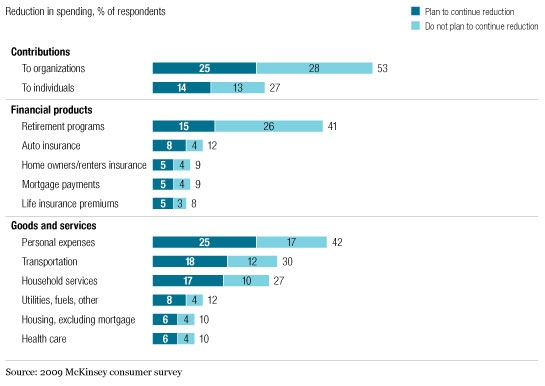

There’s little reason to expect that US consumers will return to their recent spending habits any time soon: in those categories with reduced spending, more than half of the respondents said that they planned to keep their expenditures down after the recession. This finding suggests that companies must develop a deep understanding of how such profound behavioral change will affect strategies fundamental to value creation: acquiring and keeping new clients, intensifying relationships with them, and improving service to consumers, for example.

Spending fell in all categories. Our survey found that 53 percent of the respondents cut their contributions to organizations; 42 percent, personal expenses; 41 percent, contributions to retirement programs; and 30 percent, spending on transportation (Exhibit 2). For spending categories, about half of those making cutbacks said they intended to keep spending at lower levels after the recession. In addition, about 65 percent of the respondents who save less than 10 percent of their pretax income said that the downturn had taught them lessons in frugality—lessons they will remember even after the recovery. They also said that they no longer want to buy many of the things they once did.

Reduced spending in past 6 months

The vast majority of US consumers are not only reducing their expenditures but also borrowing less, aggressively paying down debt, and saving more. In the three months to the end of June 2008, net consumer mortgage borrowing turned negative for the first time since the Federal Reserve began tracking fund flows, in 1946. In the final three months of 2008, net consumer credit borrowing was negative for the first time since the fourth quarter of 2002. Across debt products such as credit cards, mortgages, auto loans, and personal loans, consumers said they were more likely to close or decrease balances than to open or increase them. This response was particularly apparent for revolving credit lines, such as credit cards.

Meanwhile, the personal-savings rate reached a 14-year high, 5.7 percent of disposable income, in March 2009.2 While that represents a significant turnaround—the savings rate was zero just a year earlier—it’s not even two-thirds of the post–World War II average of around 9 percent, suggesting that it may continue to increase. While the vast majority of respondents said that they didn’t plan to change their investment portfolios, those who intend to do so indicated a preference for more secure investments, such as savings accounts and certificates of deposit.

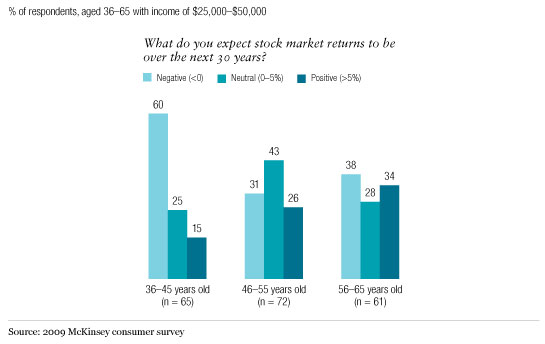

Finally, the historically poor returns of US equity markets during the lives of investors under the age of 45 may be creating a generation of equity-averse consumers. Less than half of US respondents believe that the stock market will produce returns above inflation over the next 30 years. Eighty-five percent of consumers from 36 to 45 believe that it won’t (Exhibit 3).

Lower expectations

Our survey suggests that the recent change in the behavior of consumers is no aberration. The aberration was their behavior during the past two decades, when the personal-savings rate actually turned negative (that is, they were spending more than they earned) and average household indebtedness almost doubled. The severity of the economic crisis—particularly its impact on house prices and the availability of credit—has prompted consumers to rethink, fundamentally, the way they act and has therefore pushed spending, debt, and savings levels back toward the long-term trend rates.